June 25, 2021

Dairy

Milk prices continued their slide since peaking the week of May 10th. Class III July only fell 7 cents on the week, while July Class IV fell 31 cents. Supply side pressures continue to be the main driver, as cow numbers continue to climb and gains in productivity per cow are strong year-over-year. This week’s May Cold Storage report showed a return to growth for cheese inventories, up 1% YoY. The April report showed a contraction in cheese inventories in the US by 2%. Total cheese inventories are still just under last year’s record high of 1.479 billion pounds. Butter in cold storage for the month of May increased 7% year-over-year, which is up from the 4% year-over-year gain seen in April.

Milk Highlights:

Milk prices fell for a sixth straight week.

US cheese inventories up 1% yoy in May

US butter inventories up 7% yoy in May

Corn

Corn fell double digits today as significant rainfall for parts of the Corn Belt remained in the 5 to 7 day forecast. Also, chances for below normal temps for much of corn country remained in the 6 to 10 day forecast. The US Supreme Court ruled in favor of some small oil refineries seeking exemptions from having to increase the amount of ethanol and other renewable fuels in their blending – this likely also contributed to today’s negative market tone. The International Grains Council increased their expectation for world corn production by 7 mmt as they expect higher output in China. The price of corn on the China Dalian Exchange has been as high as $10.20 on the Sep contract – helping to fuel increased production interest. For the week, July corn fell 16 cents and new crop December fell 46 cents. New crop December has fallen two consecutive weeks in a row, from a recent high of 6.28, to today’s close of 5.19.

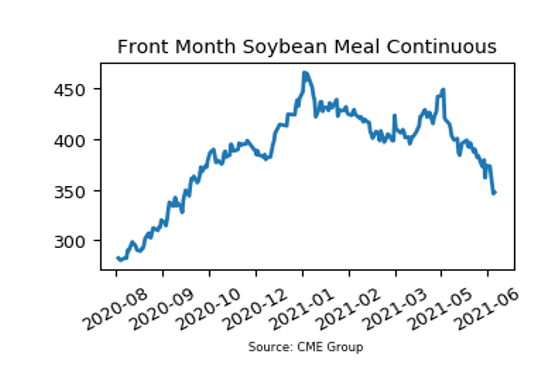

Soybean Meal

Soybean meal was the lone stronger market today. Price action started weaker with contracts down 3-4 dollars, but then momentum shifted dramatically about 30 minutes after the 8:30am CT reopen. At the high of the day contracts were up 7-9 dollars, with the deferred months leading the way. For the week, meal still finished down 24 dollars. In just 30 trading days the front month meal contract has dropped 117 dollars from the May 12th high of 457.00, to yesterday’s low of 340.00. From the January high to yesterday’s low the market is down 131 dollars per ton.

Today’s Market Quotes