July 29, 2022

Tumultuous Week to End Volatile July

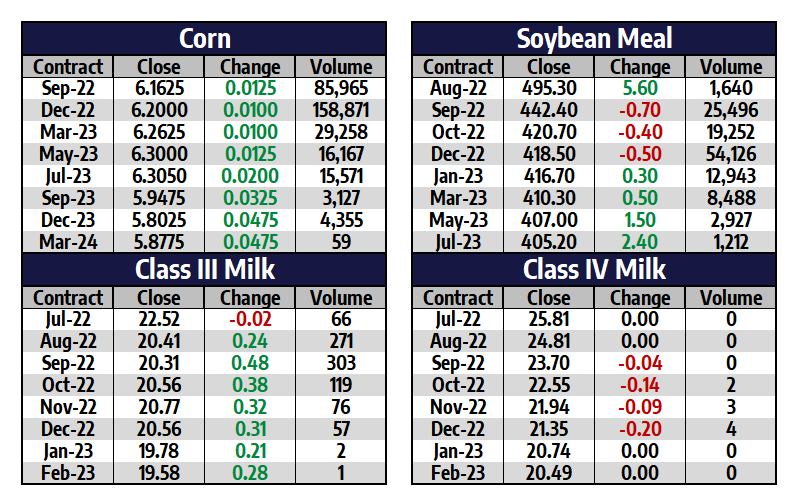

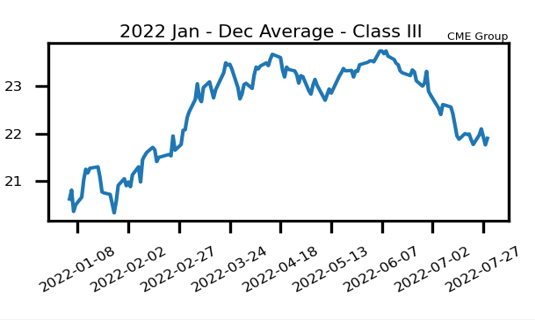

Class III futures posted a positive weekly close with the August contract up 18 cents and September gaining 42, an impressive feat seeing Wednesday and Thursday’s losses totaled $1.00 and 91 cents, respectively. This leaves a tail on the charts for these contracts with a break off the early week high, but the oversold nature of the markets and the fact $20.00 held on the continuous second month chart is encouraging. Spot cheese had an equally wild week, gaining 3.6250 cents in Friday’s trade, but dropping 3.1250 cents on the week to $1.88375/lb, the lowest weekly close in 2022. Things were quieter for Class IV, which saw its August contract up 34 cents this week to close at $24.81, as that market tries to re-establish an upswing after a moderate selloff in recent weeks.

- For the month of July, August Class III futures fell $2.41 cwt, while spot cheese plummeted 31.1250 cents

- Within the Class IV market, the month of July saw the August contract fall $0.42 cwt, while spot butter dropped half a cent

- Attention will shift to the September contracts on the rolling second month charts next week. It will be important for Class III support to hold at $20.00

- Spot butter has strung together nine weeks of trade between $2.90/lb and $3.00/lb

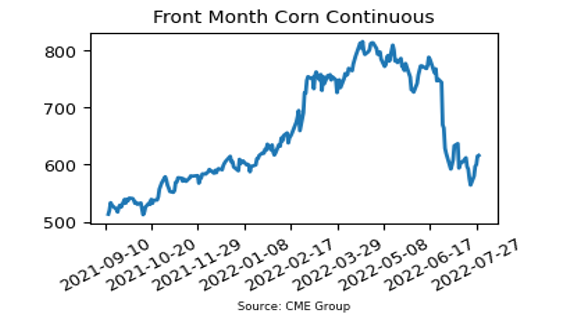

Corn Posts Strong Recovery

– September 2022 corn jumped 55 cents this week while the new crop contract rallied 55.75 cents to push both contracts back over $6.00

– There was enough concern with the updated forecasts into early and mid-August to add some weather premium back into prices

– China’s corn imports were down 38.2% YoY at 2.21 million tons and were down 11% in the first six months of 2022 vs. the same time period in 2021

– Brazil and China are revisiting on a trade protocol to allow Brazil to ship corn to China sooner than originally established

– FCStone estimates the US corn yield at 174.5 bpa vs. the latest estimate from the USDA at 177.0 bpa

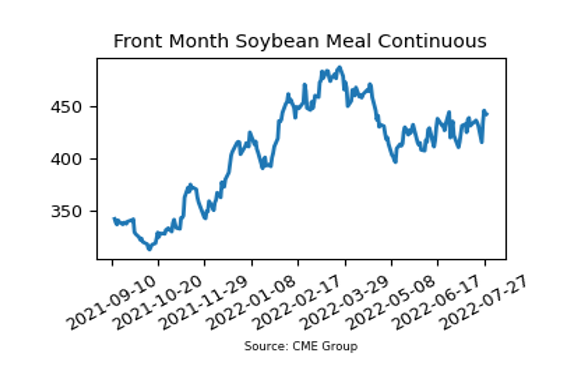

Soybean Meal Break Out of Recent Range

– September soybean meal rallied $43.10/ton on the week to $442.40, back near contract highs from March

– The soybean complex found hefty buying this week thanks to a more threatening forecast for August

– Private exporters sold 132,000 metric tons of 2022/23 soybeans to unknown destinations on Friday

– FCStone estimates the average US soybean yield at 51.9 bpa, up slightly from the current USDA estimate of 51.5 bpa

Friday’s Market Quotes