July 30, 2021

Milk Prices Climb to End Week

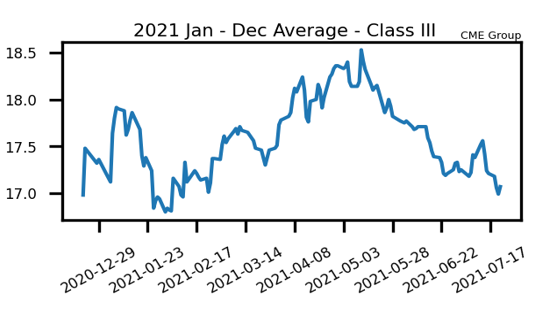

Class III milk futures held modest gains during Friday’s trade. August futures finished the week with losses of 10 cents and the month with losses of 84 cents as it shifts to the front-month contract, now almost $4.00 off its high from May 12. The block/barrel average was down slightly today but up 1.875 cents on the week and 6.5 cents higher vs. its fresh 2021 low posted last week. The fact that cheese prices have bounced after hitting a new low is a good start, and if the block/barrel average can continue to push up into the $1.60’s/lb, Class III prices are likely to bottom soon.

Milk Highlights:

Cheese prices are holding above critical support near $1.48/lb after hitting new lows recently

Milk Futures still have the potential to test $15.50 on the second-month contract if they follow the recent cheese trade to new 2021 lows

June Milk Production was 2.9% higher from the same month last year

Cheese in Cold Storage fell 1% from June 2020 while butter stocks were up 14%

Corn Prices Choppy

Corn prices closed out the trading day with what looked to be a negligible week of trading, losing a whopping 0.5 cents on the week. But if you look at the candlestick you can see it has been a choppy week with the September contract sporting almost a 30 cent range despite the minimum difference in price week over week. Weekly export sales were disappointing and continue to trend in the wrong direction as we posted another week of net cancellations in sales. The range in analyst estimates for this years crop final yield continues to vary widely with some individuals at 175 bpa and others closer to 182 bps. This compares to the USDA trendline yield of 179.3 bpa. The ridge has been seen to be weakening in areas like South Dakota and Iowa to give better chances of rain and lower temperatures.

Soybean Meal Near 2021 Lows

The August soybean meal contract ended the week with losses of $2.20/ton today to trade within $6/ton of the 2021 low at the lows of this trading week. The soybean meal market hasn’t traded into a new high week over week since June as the meal market continues to struggle. Prospects this week of improved chances of rain in the Dakotas and Iowa pressure the market lower. Lower veg oil prices continue to be a negative factor for the soybean complex as a whole. Weekly export sales announced were also net cancellations on the week over 70,000 metric tons. Hot temperatures are expected to return as we move into the beginning of August and could add more momentum to the market.

Today’s Market Quotes