August 6, 2021

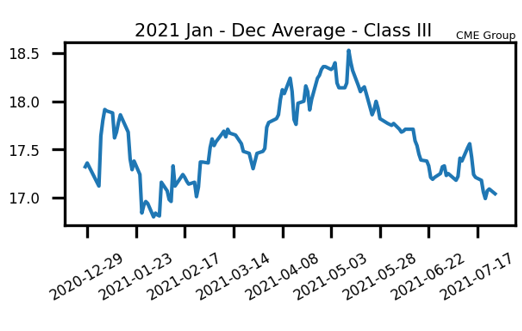

Class III Buyers Support The Market

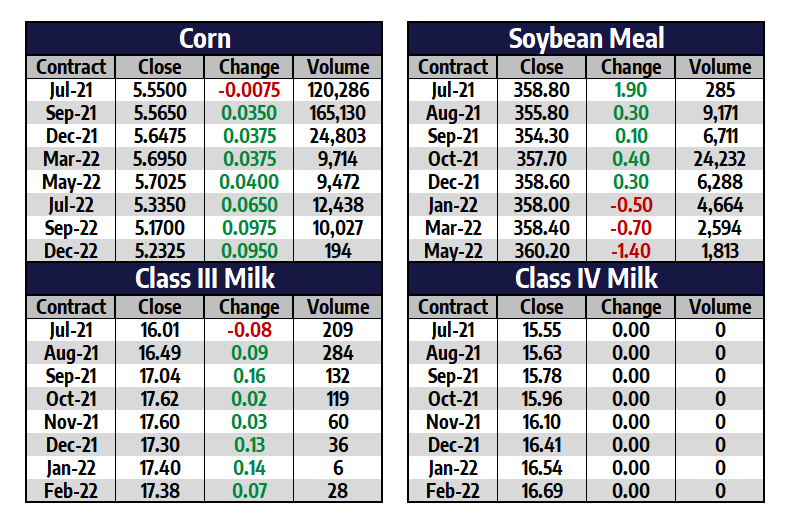

Milk Highlights:

Cheese prices are holding around $1.50/lb as the market stagnates. This could take futures lower if the market can’t move higher

Milk Futures are showing reversal esque price action this week after trading to a low of $15.75 to finish the week at $16.50

June Exports for dairy were once again a record for the respective month of June, up 4% YoY

Cheese exports did fall 13% YoY as butter whey and NDM made up the difference in the fall

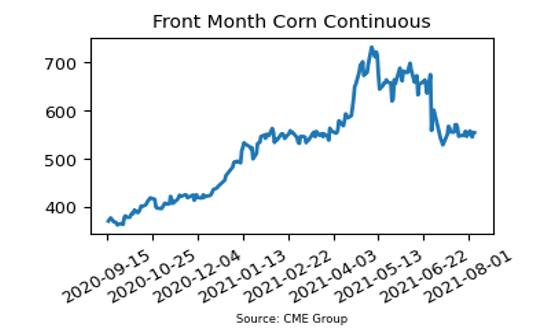

Corn Prices Up Slightly

Corn prices continue to trade in a very consolidated manner as the continuous chart holds onto the 200-day moving average into the end of the week by a thread. The September corn contract was up 8 cents on the week as trade was choppy. The market seems to be in a holding pattern until the USDA releases the WASDE report next Thursday. Average trade estimates going into the report are looking for the USDA to drop U.S. carryout and yield vs. the July report. Average trade estimates are also expecting the USDA to lower the Brazil crop number for corn as well. With the majority of analysts looking for bullish results, even a neutral from the USDA could drag the market lower.

Soybean Meal Rangebound

The August soybean meal contract ended the week with gains of $4.5/ton to overcome the net losses of $2.20/ton last week. Price action in the meal market remains stagnant near the lows for 2021. The price action shows a clear lack of buying interest at current levels. The market is likely holding tight until the WASDE report being released on Thursday of next week. The average of analyst estimates is expecting the USDA to decrease carryout and production on this report. With the majority of analysts expecting bullish changes on the report, even a neutral result could take the market lower.

Today’s Market Quotes