August 13, 2021

Dairy Finishes the Week Strong

Milk Highlights:

The cheese market rebounded this week, spurring a recovery in class III milk futures

The September 2021 class III milk futures contract nearly finished limit higher two days this week. Volatility is still high

June Exports for dairy were once again a record for the respective month of June, up 4% YoY

Milk cows on farm fell 1,000 head from May to June. This is the first decline month-over-month in a year

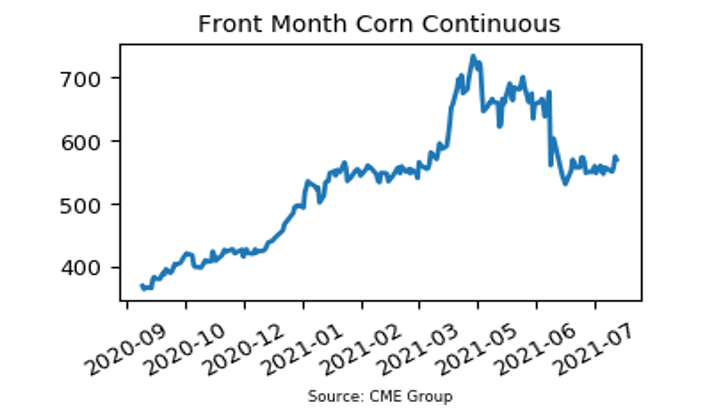

Corn Gains 13.25c This Week

Corn futures worked higher for the second week in a row, supported by a friendly USDA Supply and Demand report on Thursday. The report showed that corn yield as of August is expected at 174.60 bushels per acre versus the July estimate of 179.50. The market reacted favorably to the USDA report on Thursday by initially jumping over 30c higher, but that move higher fizzled out by the end of the session and the market closed up just 14c. Today, focus was on the fact that there is a chance for moderate rain in the western Corn Belt in the coming days. Day four of the DTN yield tour has Illinois yield pegged at 203.50, Indiana at 190, and Ohio at 187. The coronavirus delta variant is also a concern for demand moving forward. This week, September corn added 13.25c and closed up at $5.6825 per bushel.

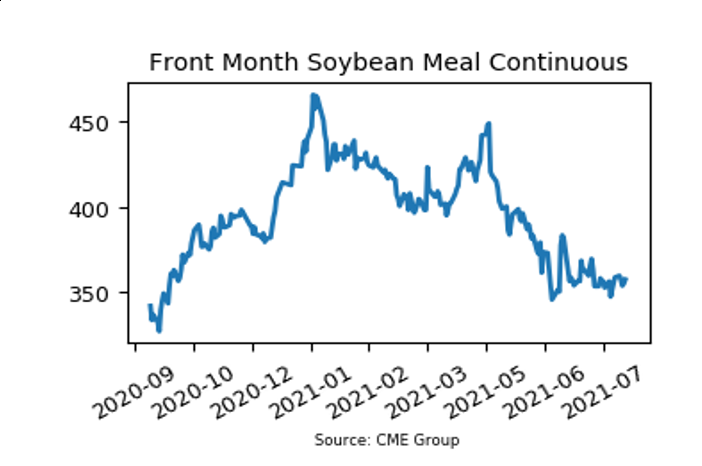

Soybean Meal Consolidates

The soybean meal market has traded in tight daily ranges for a few weeks now, and that continued this week. The September ’21 soybean meal futures contract added just $1.80 per ton this week, closing at $357.60. The USDA pegged 2021 soybean yield at 50 bushels per acre on the August WASDE report. This is down from the July estimate of 50.80 bushels per acre. The fact that US old crop ending stocks for soybeans jumped from 135 mb to 160 mb is concerning. There may be some uncertainty around final ending stocks numbers until the release of the September 30th report. On the bright side for the soybean complex, there have been 6 days in a row of export sales. Today there was an export sale of 326,000 metric tons to unknown and 126,000 metric tons to China.

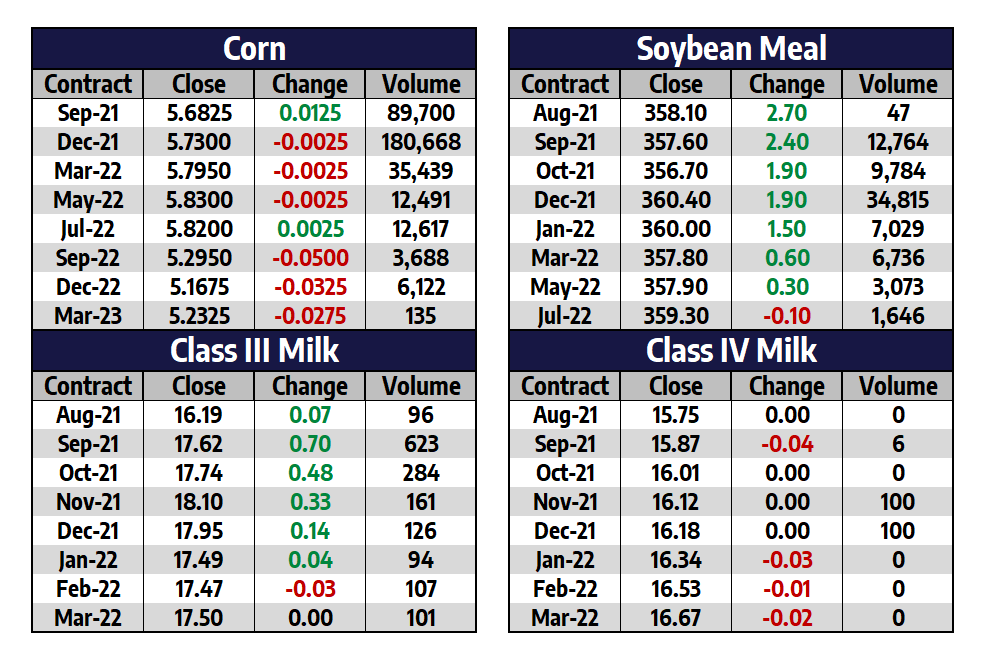

Today’s Market Quotes