August 27, 2021

Class III Milk Struggles This Week

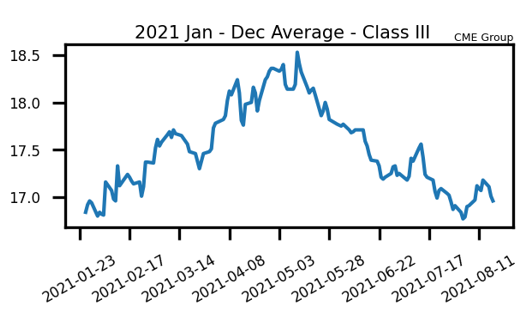

Class III milk futures worked to the downside for the second week in a row as the market gives back what was gained earlier in the month. For the week, September ’21 class III lost 30c to $16.76 while October fell 43c to $16.62. Some pressure is coming from the fact that the recent spot cheese rally has fizzled out right near trendline resistance. Demand for cheese lacked this week in the spot trade. Regional cheese reports across the country still show positive signs. There is talk that spot milk availability is not as readily available as it once was and the $2 or $3 discounts below market are gone. There is also talk that some cheese plants have had to turn away new orders. With production tightening up after the spring flush, this should be a supportive factor moving forward.

The class IV trade had a good week, with some contracts up for the third or fourth week in a row. September ’21 class IV milk added 28c this week to $16.17, and is currently 72c above the July low. The fact that spot butter and spot powder prices are curling higher again is a supportive factor there. Also, recent GDT auctions have shown better global demand for the class IV products. The next GDT auction isn’t until September 7th, though.

Milk Highlights:

Class III milk futures are struggling to rally despite a strong seasonal time of year

Milk production for July came in just 2% greater than the same month last year

Milk cows on farm across the US are down 9,000 head from the May peak

Feed costs are high, dairy export demand is strong, and production growth is tigthening up

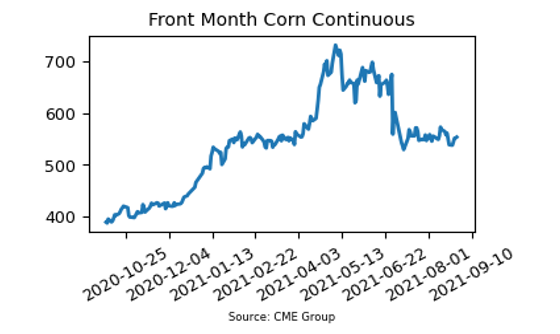

Corn Adds 16.75c This Week

Corn futures found support this week and rallied 16.75c after a sluggish 36c drop during last week’s trade. A 2% decline in the good to excellent crop ratings on Monday helped support higher prices this week, with US corn now rated 60% good to excellent. This is 4% below its rating through this same week last year. The USDA said that 85% of the US corn crop is in the dough stage with 41% dented. The market will watch weather over the weekend as tropical storm Ida is expected to make landfall on Sunday. This storm should send heavy rains to the North and maybe some to the eastern corn belt. Dip buyers supported the market this week, but next week will bring another crop progress report with a Supply and Demand report for September not too far away.

Soybean Meal Falls $1.50 To $350.40

Soybean meal futures dropped for the second week in a row, falling $1.50 per ton to $350.40. There may be some concern about demand for soybeans, as well as relatively big numbers coming out of South America for their 2022 crop. Although, US soybean prices are still cheap relative to Brazil. Yesterday, the USDA announced a 9.7mb sale of new crop beans to China and unknown destinations. US soybean conditions fell again this week and are down to just 56% good to excellent. The USDA also said that 97% is in bloom and 88% are settling pods. China reported zero new Covid cases on Monday, which added some support to commodities this week.

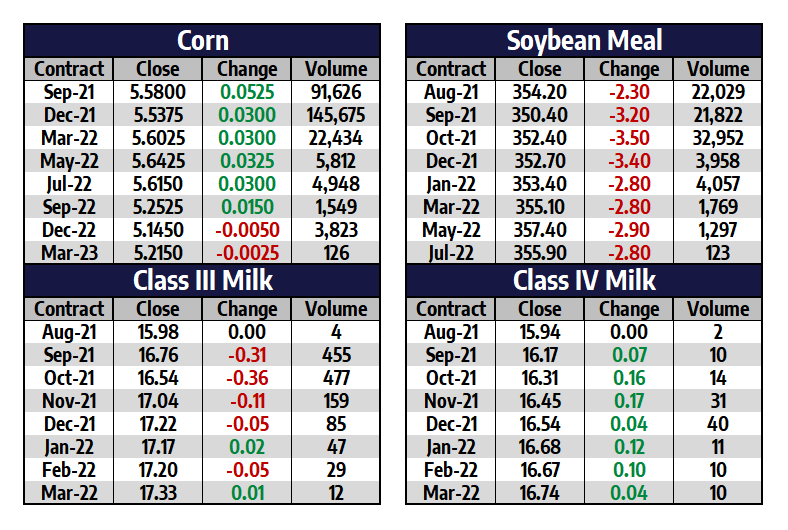

Today’s Market Quotes