September 16th, 2022

Mixed Week for Dairy

October Class III futures, the block/barrel average, and spot whey all closed higher on the week. The action was volatile with October futures putting in its weekly high of $22.05 on Tuesday before breaking hard, then bouncing off a Friday morning low of $20.78. Class IV futures finished the week two-sided but avoided any major moves, while spot butter came under selling after closing at $3.24/lb on Tuesday, a new all-time high. Many commodities felt the weight of a worse-than-expected CPI report on Tuesday which caused a dollar index rally, and some concern is warranted given the bearish cheese production/supply and the fact that spot butter’s move above $3.00/lb could lead to some demand destruction. Next week, August Milk Production is released Monday, a GDT Auction takes place Tuesday, and August Cold Storage will come out Thursday.

- After hitting a new high of $3.24/lb. Tuesday, spot butter fell 3.25, 3.50, and 4.00 cents in the next three trading days to close out the week at $3.1325/lb

- The block/barrel average has traded higher for 9 of the last 11 trading days

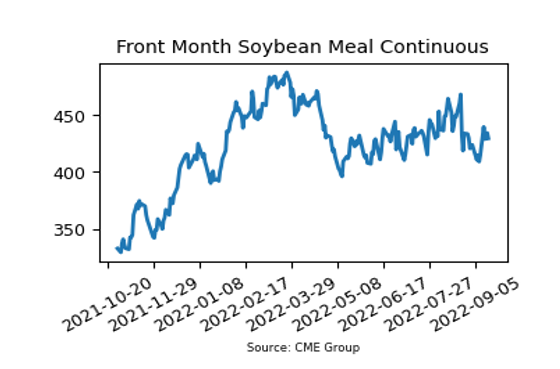

- December corn futures were down 7.75 cents on the week within a 32-cent trading range; soybean meal futures are still in the range they have held the majority of the last 5 months

- Front-month heating oil futures hit a five-month low this week with a move to just above $3.11/gallon

Corn Report Gains Washed Away During Week

- December corn futures jumped 11 cents on Monday to finish the day at $6.9950, touching highs not seen since late June; however, those gains were erased on the week overall with December futures down 7.75 cents

- China is reducing the use of feed grains (corn and soybeans) in animal feed to ensure food security; the proportion of corn used in feed was down 20% compared to recent years

- EU corn crop falls 21% this year due to drought, Copa-Cogeca reports

- Brazil C-S 2022-23 summer corn seeding was 17% complete as of 9/8 according to AgRural

- Ukraine’s corn crop is near average but the war will slow harvest pace (Agritel), Ukraine crop would be 12M tons below last year’s crop while only slightly behind the 5-year average

- October crude oil finished $3.38 lower yesterday, causing economic concerns (as well as concerns about demand for biofuel)

Soybean Meal Choppy but Up Overall

- December bean meal futures gained nearly $24.00/ton on Monday on a bullish USDA report for the bean crop, however, after some sell-off, December futures settled up close to $12.00/ton on the week overall

- Monday’s USDA report pegged US soybean yield came in at a surprisingly low 50.5 BPA, the average soybean yield estimate for Monday was 51.5 BPA, down from 51.9 BPA on August’s report

- Monday’s report also cut expected harvested area, between yield and acre changes the report projects ending stocks to be 200 million bushels, down 45 million from the August report

- Export sales report showed soybean commitments up 13% from a year ago

- Brazil and Argentina soybean meal and oil prices are cheaper than the US and tension between US and China concerning Taiwan may result in China focusing on purchases from those South American countries

- Stats Canada has 2022/23 canola production at 19.099 million metric tons, up from 13.757 mmt last year

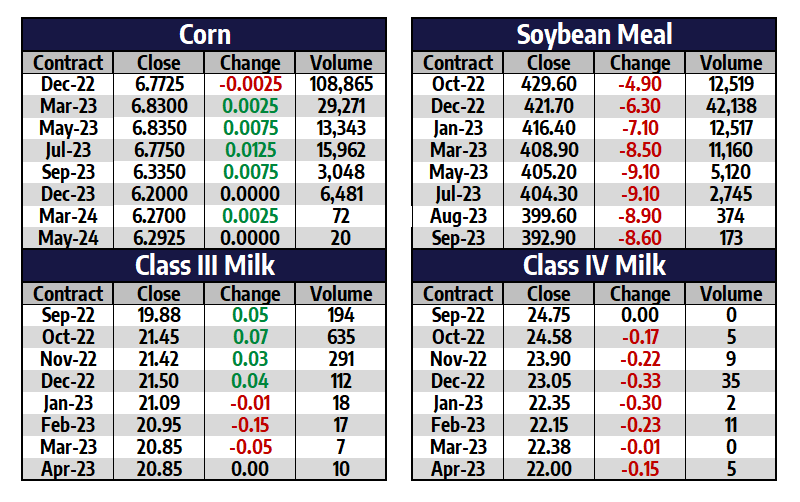

Friday’s Market Quotes