September 30th, 2022

Class III Struggles at $22.00 Again

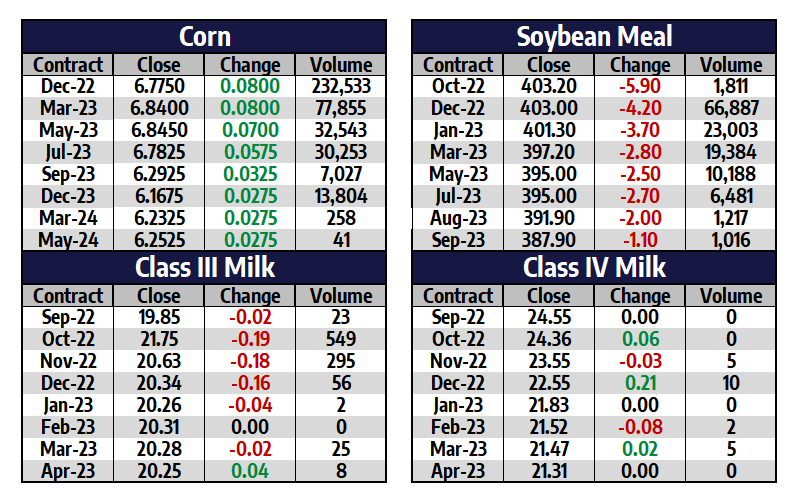

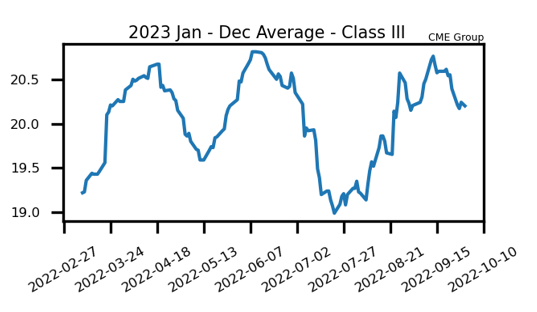

The October Class III contract came under selling pressure at the $22.00 mark once more, closing down 19 cents on the day but still up 85 cents on the week. The Class IV trade was mixed today but the October contract was up 6 cents on the day/week to close at $24.36, 81 cents above the November contract as the calendar shifts to a new month and quarter on Monday. The spot trade was quiet today on low volume and movement. Next week will give the market a Dairy Products Production report on Tuesday as well as a Global Dairy Trade Auction, followed by August Dairy Exports on Wednesday.

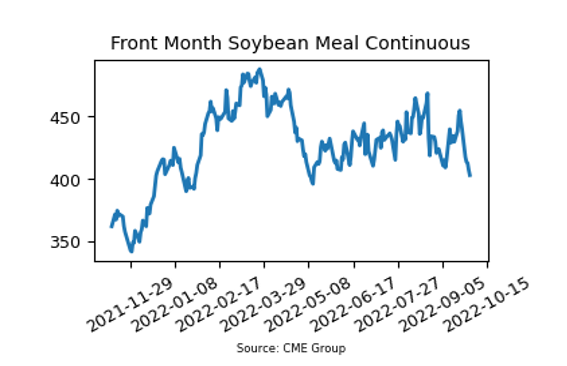

- Front month soybean meal futures finished the day at $403.00/ton today, the lowest close since May 12th

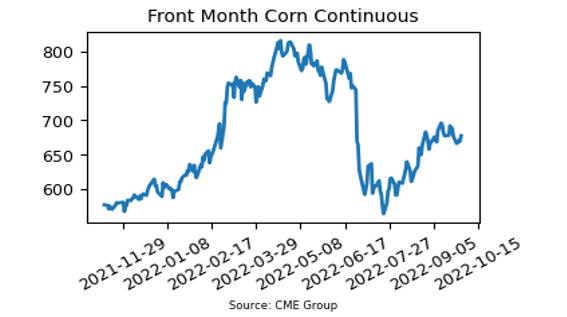

- December corn closed 8 cents higher on the day but 18.75 cents off its peak; that contract was up 0.75 cents on the week

- Spot cheese was up 1.1250 cents on the week while butter garnered 1.25 cents overall

- Front month heating oil futures are hanging in the middle of a 35 cent range for the week after hitting 6-month low Monday

Corn Essentially Unchanged on Week

- December corn futures closed the week 0.75 cents higher at $6.7750 within a 34.75 cent range

- US corn harvest is 12% complete as of Monday’s Crop Progress report, 2 points behind the 5-year average

- Ethanol production for the week ending September 23rd totaled 5.985 million barrels, down 5.11% WoW and down 6.46% to its lowest level in nearly 2 years

- Ukrainian President Zelenskyy said he believes Russia will attempt to disturb the current grain shipment agreement

- Today’s Quarterly Stocks report had September 1st corn stocks at 1.377 billion bushels, down from the average estimate of 1.497 bb and up from 1.235 bb a year ago

Soybean Meal Testing Support

- December bean meal futures closed down $20.30/ton this week at $403.00, testing long-term support at $400.00

- Soybean harvest is 8% complete as of Monday’s Crop Progress report, down from the 5-year average of 13%

- South America soybeans remain cheaper on the world scale than US supplies

- Argentina’s 2022/23 soybean production is expected to be up 11% from the previous season to 48 million metric tons, according to the Buenos Aires Grains Exchange

- Today’s Quarterly Stocks report had September 1st soybean stocks at 274 million bushels, up from the average estimate of 247 mb and up from 257 mb a year ago

Friday’s Market Quotes