October 2, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

Milk

Milk futures are moving steadily higher as a response to strong bidding in the spot cheese, powder, and whey markets. October class III just moved into the front month spot and is trading over $20.00. November finished the week up at $19.30 and December closed at $17.84. Class IV, meanwhile, is trading at much lower levels between a range of $13.74 and $15.60. News has been relatively quiet for the market, but the strong spot market demand is keeping the rally intact. This week, October class III gained $1.25 per hundredweight. Looking ahead, milk production totals will be watched closely as production had been ramping back up again in July and August. A strong year for milk prices as well as plenty of government aide and good feed quality could keep milk production higher.

- Nearby milk is holding a strong premium to the further out contracts due to a strong spot trade

- October class III jumped back over $20 per hundredweight this week

- 2021 milk continues to slowly push higher

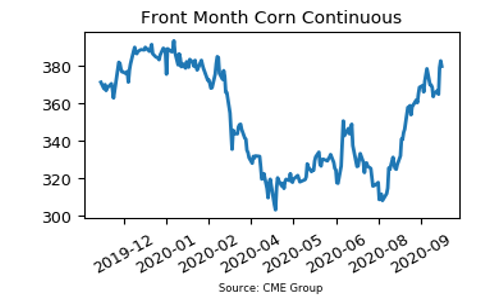

Corn

Corn futures posted a nice recovery this week, continuing the move to the upside. The front month December contract ended up 14.50c above last week’s settle to $3.7975 per bushel. The big story of the week was the fact that the USDA announced lower September 1 ending stocks than the market had expected. The USDA estimated corn ending stocks near 1,995 million bushels versus the 2,250 million bushel expectation. This compares to last year’s 2,221 million bushel figure. The December contract rallied 14.25c the day of the news and held those gains into Friday. Aside from that, farmer selling has been slow despite the recent rally. Weather forecasts the next two weeks look good for plenty of harvest activity.

- Corn futures jumped another 14.50c this week and posted a strong close over prior highs

- Farmer selling has been slow despite the recent rally

- Weather forecasts look good the next two weeks for steady harvest progress

- This past Wednesday’s USDA Grain Stocks report was bullish and could keep the rally going

Soybean Meal

Soybean meal futures rallied into new highs for the move on Friday after another impressive week. The front month October contract finished the week up $12.50 per ton to $349.40. This is the front month contract’s highest settlement since June of 2018. Wednesday’s USDA quarterly Grain Stocks report was a bullish one that helped propel this rally into new highs. The USDA estimated September 1 soybean stocks near just 523 million bushels versus market expectations for 576 million bushels. Additionally bullish, this compares to last year’s 909 million bushel figure. Soybean export sales are running 26.60% ahead of the average pace. Some producer selling has picked up on the recent rally.

SBM Highlights:

- China made another large U.S. soybean purchase on Friday

- Soybean meal futures hit a new high for the move

- Export pace for soybeans is running well above average

- This past Wednesday’s USDA Grain Stocks report was bullish and could keep the rally going

Market Quotes