October 9, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

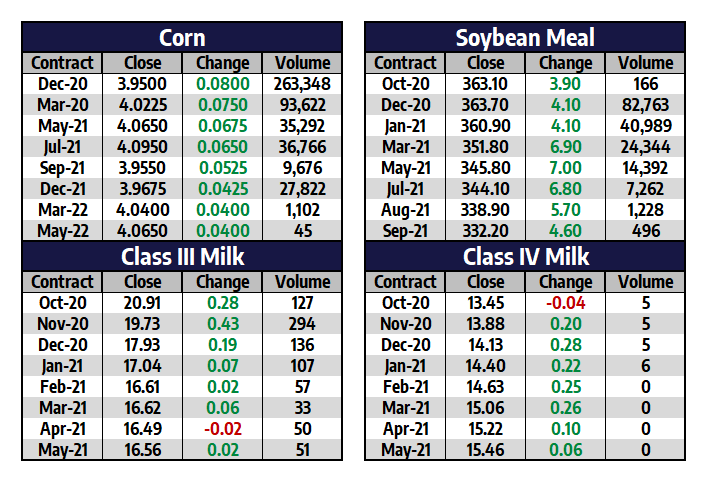

Milk

Milk futures had a solid week of trade this week and continued to work to the upside. During the week, the October, November, and December class III milk months all hit fresh contract highs. The market is supported by very steady demand for U.S. cheese, with blocks now at $2.6475/lb and barrels up to $2.0550/lb. The spread between the two cheese markets is still wide, but has tightened quite a bit over the past couple weeks. October class III milk is up to $20.94, November is at $19.74, and December is $17.92. There continues to be a lot of premium in the nearby months, while the further out contracts hold a pretty big discount. The 2021 average class III price is only $16.71. This market structure is a sign of a bull market. While class III works higher, the class IV milk trade (comprised of butter and powder prices) has struggled. Front month class IV is down at $13.45 per hundredweight.

- Milk futures continue to rally to the upside, supported by a very strong spot cheese trade

- The spot cheese block/barrel average gained another 6.875c this week and closed at its highest level since mid-July

- 2021 milk is within a penny of hitting its highest price on record

- Dairy exports have been strong in 2020

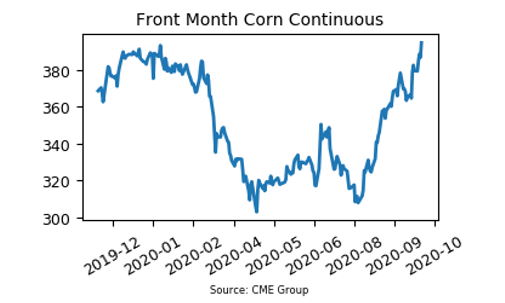

Corn

Corn futures added another 15.25c to the topside this week after the market had gained 14.50c last week. This puts the front month December contract now up to $3.95 per bushel after bottoming in August at $3.20. A couple news items heading into today’s USDA Supply and Demand report were that China has been an active buyer of US corn for April delivery. The market had also expected a lower corn yield, lower production, and lower harvested acres. The report was released today at 11:00am CST and brought a lot of volatility with it. In the report, the USDA put 2020 corn yield at 178.40 versus its September figure of 178.50 bpa. The market had been looking for a number closer to 177.60. Harvested corn acres came in at 82.50 million acres versus market expectations for 83.30.

- Corn futures posted a strong weekly close up at $3.95 on the December contract. Best price since January 2020

- The USDA cut corn yield on Friday’s report to 178.40 bushels per acre versus 178.50 in September

- The USDA lowered harvested corn acres in 2020 to 82.50 million acres. More fuel for the bulls

- The market is into overbought conditions so a pullback could be coming. However, fundamentals remain bullish

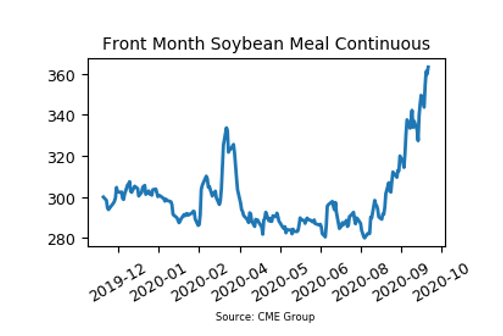

Soybean Meal

Soybean meal futures had a higher close for the seventh time out of the past eight weeks. This week saw the December contract tack on $11.80 to post a $363.70 close. This has been an impressive move so far for meal, which is now up $77.50 from its August low. Rumors of a delayed soybean planting in Brazil that could drive China to buy soybeans from the U.S. is keeping the market in a bullish environment. Also, today’s USDA Supply and Demand report should keep the bullish tone in the market. The USDA left U.S. soybean yield at 51.90, which is the same as what was reported on the September report. The market had been looking for a slight cut to 51.70 bpa. Harvested acres fell more than expected, however, with a cut from 83 million acres to 82.30 million acres. The market was looking for 82.90 million acres.

SBM Highlights:

- Market conditions remain overbought. Be on the lookout for a correction in the near term to help cool off the chart technicals

- Rumors of delays in Brazil’s soybean plantings could lead to China buying more beans from the U.S.

- South American weather continues to be watched closely

- There were no daily export sales notices on Friday

Market Quotes