October 15, 2021

Solid Week For Milk Prices

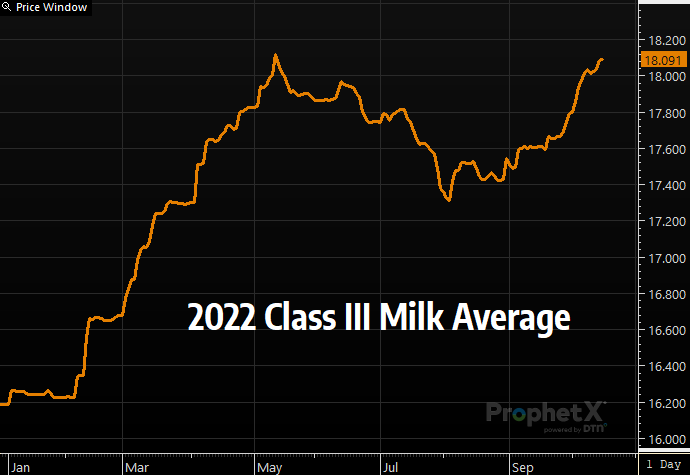

The November Class III contract finished the week 56 cents higher at $19.28, $2.53 off its pivot low from September 20th. The block/barrel average has pushed back under the $1.80/lb mark, just beneath its 2021 high from May. Resistance at that line has held with spot cheese down 1.5 cents on the week. Barrels have pushed a penny above block prices, an inversion that historically does not last for long. Whey prices continue to shine with another positive weekly close, finishing $0.0075 higher at $0.6025/lb to string together six higher weeks in a row. Whether prices can break into the $20.00 range is likely hinging on whether cheese prices can break out to fresh 2021 highs, unless spillover strength from Class IV prices provides enough of support. Regardless, some risk management is warranted at these levels with a mind to the remainder of Q4 and beginning of 2022.

Class IV prices broke out of their long-term sideways range early in the month and were able to find some follow-through this week with the November contract closing up 47 cents at $18.07. This is the first time in seven years the second month has traded with an $18.00 handle and still leaves potential for additional technical follow-through. Fundamentally, spot butter has now hung between $1.70 and $1.80/lb for two months compared to its 2021 high close of $1.88/lb. During the seven-year span where Class IV futures failed to manage a breakout, butter spent a lot of time in the $2.00+ range, leaving room for further optimism for milk prices if butter can break higher. Powder prices tacked on another 7.25 cents this week to move to $1.5325/lb, their highest level since 2014, and have aided in getting Class IV prices to some attractive levels.

Corn Posts Strong Finish To Week

After a bearish leaning USDA Supply and Demand report release on Tuesday, the corn market fell 20.75c over the next two days. In the report, the USDA raised corn yield from 176.30 bushels per acre in September to 176.50 bushels per acre in October. The USDA also raised corn ending stocks from 1.408 billion bushels to 1.50 billion bushels. The market immediately ran into selling pressure. However, Thursday’s 4.50c recovery along with Friday’s 9c move to the upside saw the corn market regain most of what it lost following the report. By Friday’s close of $5.2575 per bushel, the corn market was down just 4.75c for the week. Additional data released this week are that France’s corn harvest is just 15% done versus a 62% average for this time of year. Brazil corn crop plantings are increasing, as conditions are favorable due to recent rains. The Ukraine corn harvest is 22% complete.

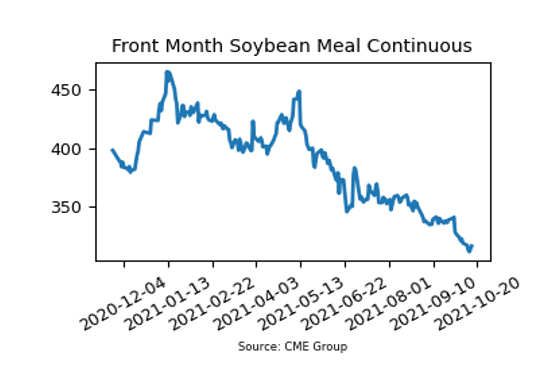

Soybean Meal Finally Finds Support

For the first time since September 10 and 13, the December 2021 soybean meal contract posted two consecutive up days on Thursday and Friday. Over those two days, the market added $4.90 per ton and looks to have found some support after being in extremely oversold territory for weeks now. For the week, the contract finished at $316.60 per ton, which is down $2.10 overall. In Tuesday’s Supply and Demand report, the USDA said that US soybean yield was raised from 50.60 a month a go to 51.50 bushels per acre. They also increased soybean ending stocks from 0.185 billion bushels to 0.32 billion bushels. There is talk that in the near future US soybean crush capacity will increase for green fuel and soybean oil. The USDA reported an increase of 42.20 mb of soybean export sales this week.

Today’s Market Quotes