October 16, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

Milk

The second month Class III milk contract (Nov) was up 1.19/cwt on the week. This is the third consecutive up week and the seventh up week out of the last eight. Over that stretch the second month has rallied over 6.00/cwt. Strength this week in Class III futures was supported by an 11 cent gain in spot cheese; spot whey fell 1 cent. This week the second month Class IV contract closed 0.46/cwt higher, and was supported by nearly a 10 cent gain in the spot butter price and a 1.50 cent gain in the spot nonfat price. The second month Class IV milk contract has gained less than 2.00/cwt since bottoming in early August. Overall the stronger momentum remains on the Class III side, yet we’ll see for how much longer. CME spot cheddar prices are now 0.79/lb higher than GDT cheddar, and at even a larger premium to the European price. This is a very significant premium and the CME market has struggled to hold at that lofty of a level vs world price in the past.

- Both Class III and Class IV milk prices were higher this week, with Class III leading the way

- CME spot cheddar price is holding a significant premium of 0.79/lb over GDT cheddar

- A potential weak seasonal window is approaching as both the months of November and December have not been favorable for higher cheese prices since 2010

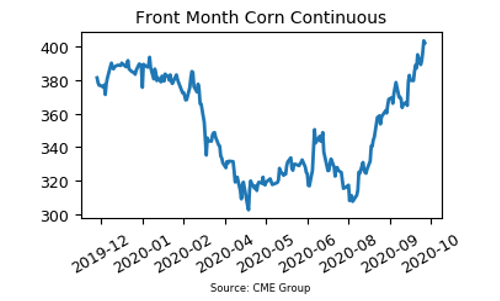

Corn

Dec corn was up about 5 cents early in the session, trading to a new one year high of 4.09. After touching 4.09, the market spent the rest of the day stair-stepping lower and closed only 1/4 of a cent off the low. Trading higher and then closing lower posts a bearish daily reversal. This reversal means that Dec did not post a decisive 52-week high breakout, so 4.30 – 4.40 is not yet the next topside target range. Today’s reversal could signal a potential top for corn for now and this week’s low of 3.8725 would be first support on the downside. Due to the Columbus Day holiday on Monday, export sales were released today. Net export sales totaled 655,165 mt over the latest week. Total commitments are now running 635 mil bushels ahead of last year, up from 624 mil bushels last week. FACE (Informa) estimated corn acres for 2021 at 92 mil vs 91 mil this year.

- Dec corn finished the week up 7-1/2 cents

- Corn has finished higher 8 of the last 10 weeks and is now testing the top end of the range of the last year

- This week spreads narrowed significantly with the Dec20/Jul21 spread up 8 cents — up more than the Dec20 contract was outright! — signaling quickly tightening balance sheet.

- Harvest was 41% done as of October 11th, vs the five year average of 32%

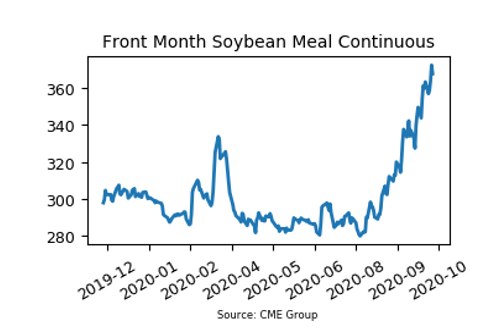

Soybean Meal

Dec meal also posted a daily bearish reversal today – trading 2 dollars higher earlier in the session and then finished over 4 dollars lower. This reversal moves resistance to today’s high and support has been moved up to this week’s low. Despite today’s reversal, the market finished the week 4.50 dollars higher and has now closed higher 9 of the last 10 weeks. This week and last week, Dec meal ran into long-term trend line resistance drawn off the 2016 and 2018 highs in the 372.00 area and so far has been unable to advance past it. Some rain is in the forecast for central Brazil and Argentina over the next 7 days. Net export sales of soybean meal totaled 152,165 mt this week, down from 581,000 mt last week. Year-to-date soybean meal exports continue to run about even with last year’s pace. Soybean export sales remain strong and total commitments are up 142% or 932 mil bushels year-over-year. FACE (Informa) estimates that 2021 US soybean acres will jump from 83.1 mil this year to 89.1 mil.

SBM Highlights:

- Closed 4.50 dollars higher on the week and up 9 of the last 10 weeks

- Brazil soybean planting pace the slowest in 10 years

- China continues to aggressively buy US soybeans on nearly a daily basis

- As of October 11th harvest was 61% done, vs five year average of 42%

Market Quotes