October 30, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

Milk

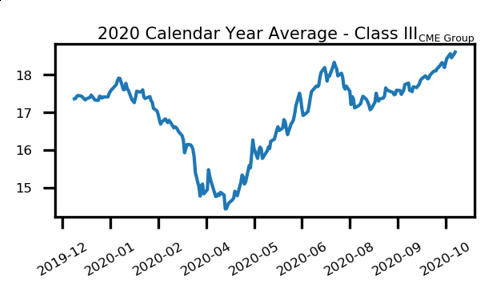

Milk futures have been extremely volatile for the past few months with limit up and limit down moves and expanded trading limits starting to become normal. This week, the third month December class III contract gained 83c on Monday and fell 76c on Tuesday on expanded limits. Normal trading limits for class III milk is normally 75c. The market is also very choppy, with an overall trend remaining higher. The spot cheese market and the fact that the government is buying product on the open market is supporting. On Friday, the spot cheese barrel market finished 6c higher and closed up at $2.53/lb. This is a new all-time high. The overall block/barrel spot cheese average is close to a record high as well. The futures market is pumping a lot of premium in the nearby milk contracts. November class III is $23.86, December is $20.42, and January 2021 is just $17.94. The class IV trade remains quiet with the nearby months priced under $14.00 per hundredweight.

Milk Highlights:

- The market continues to pump premium into the nearby contracts. November 2020 class III milk finished the week at $23.90.

- The spot cheese barrel market closed up at $2.53/lb on Friday which is a new all-time high

- The 2021 class III milk average struggled into the end of October. The average was up just 0.50c this month.

- Class III milk holds a strong premium over the class IV trade.

Corn

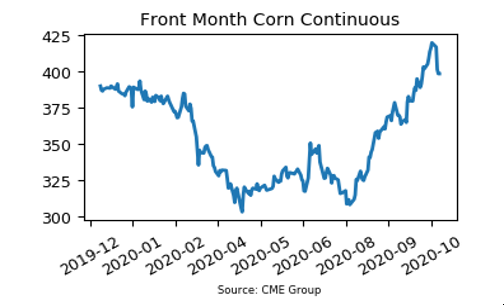

Corn futures reversed this week and gave back all of last week’s gains. December 2020 corn was down 20.75c and posted a $3.9850 per bushel close. The market cracked below the $4.00 level on Thursday and wasn’t able to get back over it on Friday. There continues to be outside market pressure from a weakening stock market and a “risk off” environment with the election coming next week Tuesday. Funds appear to be position squaring ahead of that. Export sales on corn continue to roll in for the U.S. as demand globally is strong. It has been reported that U.S. corn sales are running 168% ahead of year ago levels. There is talk that China will remain a large buyer as they prepare for covid impacts. The election will be watched very closely next week so expect more volatility ahead.

Corn Highlights:

- December corn futures had their first down week in the past five weeks

- The market was technically overbought, so a correction could be healthy

- Strong corn export sales notices came through again this week with large purchases from Mexico

- The next Supply and Demand report will be on November 10th

Soybean Meal

Soybean meal futures posted just their second down week out of the past ten. The market gave back $7.80 overall and closed at $378.60 per ton on the December 2020 contract. Buyers returned to the market later in the week and did help to close contracts a few dollars off of the weekly lows. Strong soybean export demand supports. U.S. soybean sales are running 145% ahead of a year ago. IGC has recently trimmed its forecast by 3 million tons to 370 million tons. Brazil is importing soybeans due to a rise in domestic prices that are at a 4-year high. In terms of weather in Brazil, rain has been hit or miss, which will continue for the next week or so. The 6 to 10 day forecast continues with moderate rainfall in the northern area with little rainfall elsewhere.

SBM Highlights:

- Although the soybean meal market pulled back this week, it is still being supported by very strong U.S. export sales

- Rain in Brazil has been hit or miss over the past few days

- There remains talk that China will continue to import more soybeans

- July 2021 soybean meal is trading right at $350 per ton

Market Quotes