November 6, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

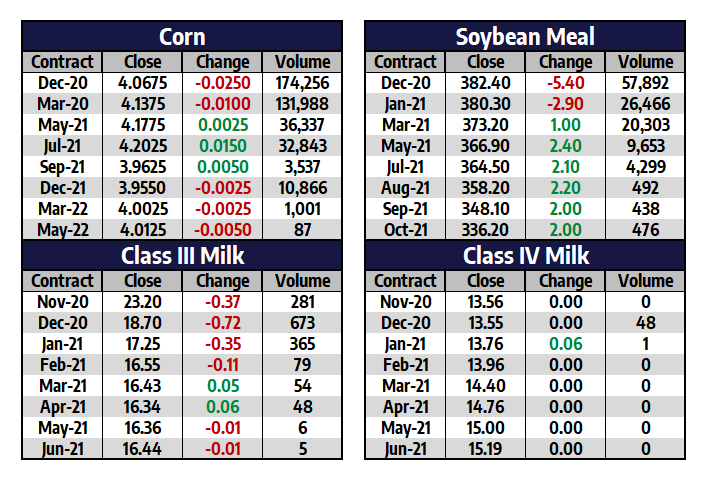

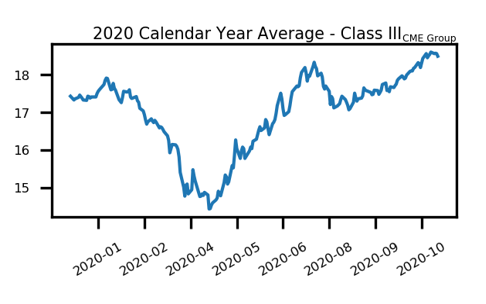

Milk

Milk futures posted yet another limit move this week of 75c. The market remains extremely volatile, making large swings in both directions almost weekly. The overall trend for 2021 milk has remained up, however. This week saw the spot cheese block/barrel average run into some strong sellers. Sellers took the average down each day this week, with the market down 32.625c by the end of the week. It is a little surprising seeing cheese fall this quickly, especially since the government announced they would continue buying products on the open market through the end of the year. Although, the cheese price was pretty elevated for an extended period of time, so some selling is warranted. The October 2020 class III milk contract settled this week at $21.61 and is now off the board. This is the second highest settlement of 2020 for class III milk. November milk is set to close about $1.50 or so better than October if the market holds recent gains into settlement.

Milk Highlights:

- The spot cheese market has done a “180” from recent highs and is selling off quickly. The price fell all five days this week

- The spot cheese block/barrel average is down to $2.33/lb after peaking out for this move at $2.65625/lb

- Class III milk futures continues to hold a significant discount to where the spot market is trading

- Class III milk holds a strong premium over the class IV trade.

Corn

The corn market recovered 8.25c this week after contracts posted a strong selloff the week prior. The front month December 2020 contract finished the week at $4.0675 per bushel, breaking back over the $4.00 barrier. There were another round of export sales announced by the USDA on Friday. A total of 206,900 metric tons of corn were bought by unknown destinations for delivery during the 2020/2021 marketing year. There were also a couple soybean purchases that came in as well. The U.S. Dollar Index has been weakening, dropping over 175 points this week. This should keep global demand strong for U.S. grains. There also continues to be weather uncertainty out of South America. The funds are back to buying corn.

Corn Highlights:

- Corn futures recovered a little less than half of what was lost last week

- The selloff took the market out of overbought conditions, which may allow price to more easily work up into new highs

- Strong corn export sales continue. The Dollar lost over 175 points this week

- The next Supply and Demand report will be next week on November 10th

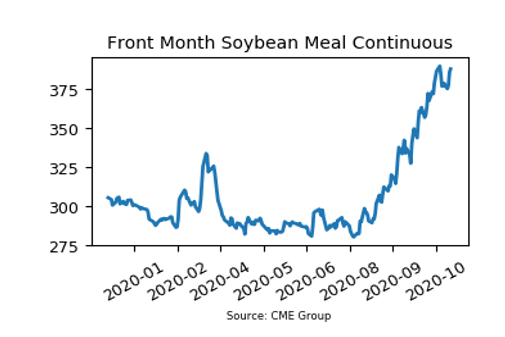

Soybean Meal

The soybean meal futures market had a steady week of trade, closing higher in three out of the five sessions. Overall, the front month December contract gained $3.80 per ton and posted a $382.40 close. United States soybean sales are running 132% ahead of last year. More export sales notices came in on Friday of this week, stating 132,000 metric tons were bought by China and 272,150 metric tons were bought by unknown destinations. Although China demand is still strong, it is not as aggressive as it was a month ago. This will be something to watch moving forward. Some resistance was put in the market due to the fact that there have been recent rains in Argentina that will give a boost to the start of soybean planting. A weaker Dollar is helping to support the soybean complex.

SBM Highlights:

- The soybean meal market continues to close in on the $400 per ton threshold. The market recovered this week from last week’s selloff

- A weaker U.S. Dollar should continue to make the U.S. market competitive on a global scale

- China was buyers of U.S. soybeans on Friday – they bought 132,000 metric tons

- South American weather is still being watched closely

Market Quotes