November 13, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

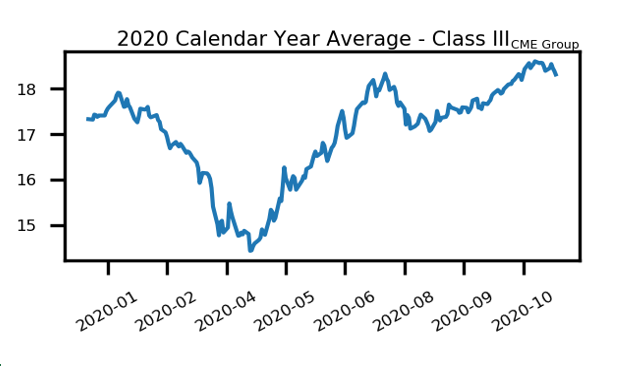

Milk

Milk futures are starting to struggle a bit as the cheese market is in freefall. The spot cheese block/barrel average fell a total of 56.625c this week and is down 89.25c so far this month. The current price sits at $1.76375/lb and has yet to post a single up day this month. News reports noted that cheese demand had been slowing in several parts of the country due to the high cheese levels, so perhaps a correction of some sorts was needed to bring that demand back. Once buyers return, cheese could bounce hard, as it has done in the past. Outside of that, there may be some concern over potential shutdowns across the country with COVID-19 cases on the rise and near all-time highs. This will need to be monitored moving forward. December 2020 class III milk closed at $17.71 today while January 2021 is trading at $16.96.

Milk Highlights:

- Spot cheese is down nearly 90c so far this month and has yet to post a single up session

- Spot cheese is pushing back below the $2.00/lb level, with nearby milk futures taking some premium out of their prices

- Class IV milk remains quiet as the market waits for movement out of butter or powder pricing

- Class III milk holds a strong premium over the class IV trade

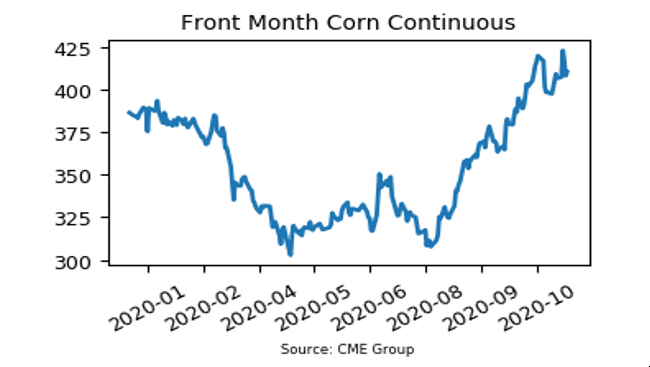

Corn

Corn futures added 3.75c this week, despite running into some resistance late in the week. The front month December corn contract hit a high of $4.28 midweek, but settled down at $4.1050 per bushel on Friday. An increase in COVID-19 cases in the United States and worldwide is keeping some pressure on the markets. Traders are concerned about potential lockdowns and the effects that could have on production. Export sales came in at 978,300 metric tons, which was down 63% from a week ago. The number one buyer this week was Mexico. Informa came out with corn acreage projections for 2021 with a number of 91.70 million. Weather forecasts for South America show moderate rains projected for Argentina in the coming days.

Corn Highlights:

- Corn futures pushed up into new highs for the move midweek at $4.28, but faded into week’s end

- A rise in COVID-19 cases has some market participants on edge

- Weekly export sales for corn came down 63% from a week ago. Mexico was the largest buyer of the week.

- The USDA Supply and Demand report was viewed as bullish

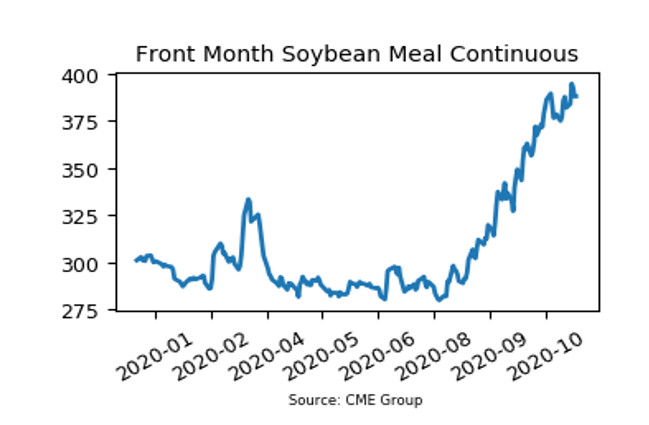

Soybean Meal

Soybean meal futures tacked on $5.70 per ton this week and tested the $400 threshold midweek. At Friday’s close, the front month December contract finished at $388.10. South American weather forecasts are showing heavy rainstorms projected for Brazil. The amount of rain that falls will be watched closely by the market. Export sales have been quiet, as there have been no announcements of sales to China or elsewhere in the past couple days. Export sales of soybeans for the week came in at 1.468 million metric tons, which was down 4% from a week ago. Informa projects 2021 soybean acres at 89.10 million. The funds are expected to be net long about 284,000 contracts of soybeans.

SBM Highlights:

- The soybean meal market tagged the $400 per ton threshold midweek but wasn’t able to finish above it

- There have been no daily export sales announcements in the past few days for US soybeans

- Rain is expected in parts of South America this week

- The funds still hold a very large amount of net long soybean contracts

Market Quotes