November 19, 2021

Huge Move Higher to End Week

Class III futures exploded to the topside on Friday’s trade led by a $1.09 rally in the December contract. That contract closed 83 cents higher on the week, which adds to what has been a wild two months of back-and-forth trade. December futures moved from a close of $17.18 on September 23rd to a close of $19.64 on October 21st before shifting lower again, closing just two days ago at $17.15. All twelve 2022 contracts traded to new highs as well, with the yearly average closing the week at $18.97. The main catalyst was another bullish production report on Thursday, with October production down 0.50% from October 2020 and yet another drop in cow numbers, along with solid spot market trade with cheese appearing to find a short-term bottom. The block/barrel average was 6.5 cents higher on the week at $1.68875/lb, with spot whey up 3 cents to $0.70/lb.

The Class IV market was no slouch this week either, mainly thanks to Friday’s action. The second month December contract tacked on 34 cents today for a 36 cent gain on the week to push to a new high on the continuous chart at $19.47. All six contracts for the first half of 2022 closed at $19.50 today, with the overall average for the calendar year closing at $19.3875. Spot butter was finally able to break above $2.00/lb this week, closing at $2.0475/lb and up 9.75 cents on the week to push to a two-year high. Spot powder is sitting 1.5 cents off its seven-year high of $1.57/lb, closing up a half cent on the week at $1.5550/lb. Class IV milk should hold onto some momentum until something gives in the underlying spot markets, both of which are sitting at multi-year highs.

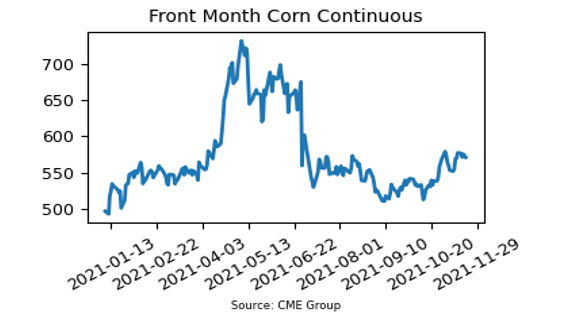

December Corn Drops 6.5 Cents This Week

Corn futures finished up one of their quieter weeks in recent memory with the December contract dropping 6.5 cents to $5.7075. What stuck out this week is the amount of resistance the market is facing around the $5.80 mark. Out of the 15 trading days so far this month, the December contract has traded over $5.80 intraday on five occasions, but closed back beneath that point every time. That being said, prices have avoided a sell-off and are hanging in at strong levels. While demand news remains mostly bullish, the higher dollar and a solid start to planting in South America may cancel out some of that optimism.

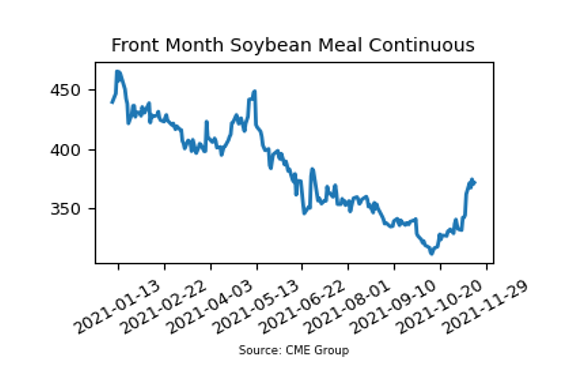

Soybean Meal Higher for Fifth Week

The December soybean meal contract has strung together five weeks of gains in a row, up $9.70/ton this week and more than $60.00/ton higher from the low from October 13th. Futures look like they may have put in a longer-term low at that time from a technical standpoint, although the fundamental news may limit the upside momentum. With soybean ending stocks now comfortably back over 300 million bushels and our South American competitors off to a beneficial start to their planting season, a move back near $400/ton may be an uphill battle.

Today’s Market Quotes