November 20, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

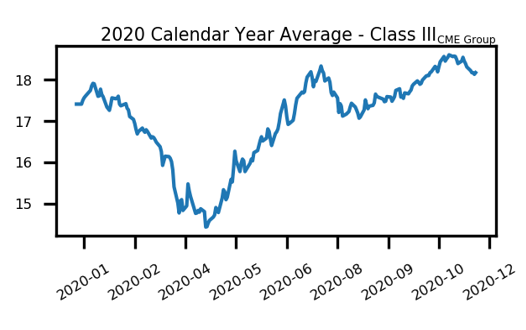

Milk

Spot cheese finally had its first up day of the month on Friday when barrels and blocks each found some buyers. Prior to today, the cheese price hadn’t posted a single up day since October 30th. Including today’s move, cheese is down a whopping $1.1225/lb this month. Government purchasing on the open market for the Food for Families Foodbox program is likely leading to this unprecedented volatility in cheese. Just last month cheese prices had been driven up to a new all-time high, before this month’s collapse. The class III milk futures have had a hard time keeping up to the cheese movement. With this current drop in cheese, the 2021 class III contracts are actually holding up pretty well – since they had been priced at a big discount while cheese was soaring. With cheese now at $1.53375/lb, the futures market is more in line with where spot is trading. Meanwhile, class IV remains stuck in the mud. Butter prices continue to weaken.

Milk Highlights:

- Spot cheese is down $1.1225/lb so far this month and just posted its first up day of the month on Friday

- Government product purchasing on the open market is likely leading to extreme volatility in cheese. When the government buys, the price soars. When they slow down purchasing, the market collapses

- Class IV milk remains quiet as the market waits for movement out of butter or powder pricing

- Class III milk holds a premium over the class IV trade, although that premium has weakened in recent weeks.

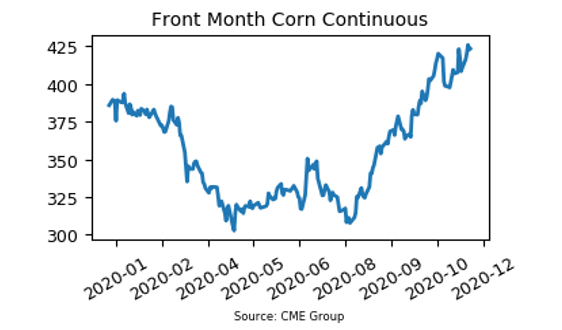

Corn

Corn futures had a strong week of trade, posting green closes in four out of the five sessions. The front month December 2020 contract gained a total of 12.75c this week to close at $4.2325 per bushel. This is its highest weekly close since May of 2018. Weather concerns in South America are keeping support beneath the market. There is talk that Argentina is dry again and is in need of significant rains soon. Additionally, the export sale notices continue to roll in. On Friday, it was announced that Mexico purchased 158,270 metric tons of corn from the United States. Additionally, unknown destinations purchased another 131,000 metric tons of U.S. corn. Weather this weekend should be good for most farmers to wrap up harvest in the United States.

Corn Highlights:

- Corn futures finished higher in four out of five sessions this week as buyers continue to support this market

- A rise in COVID-19 cases has some market participants on edge and may be keeping a lid on the market for now

- Mexico purchased another large amount of corn from the U.S. on Friday. Export sales are strong

- The November USDA Supply and Demand report was viewed as bullish

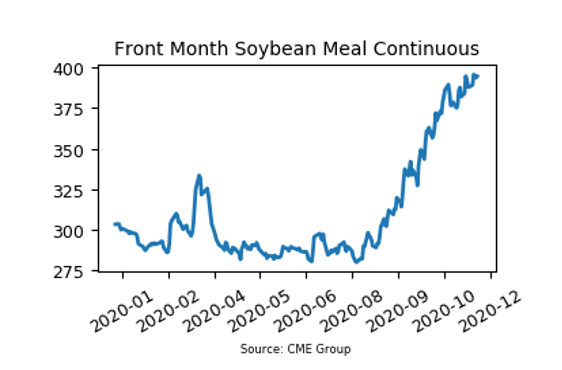

Soybean Meal

Soybean meal futures continue to consolidate right beneath the $400 per ton barrier. The market was really choppy this week and did make a few attempts to break through that level, but was never able to. The high of the week came in at $399.50 on the front month December contract. Overall, the contract posted a $6.60 per ton gain to a $394.70 settlement. The soybean market is technically in overbought territory, so some resistance is to be expected here. Brazil is expected to receive some critical rainfall late next week. This will be watched closely by the market all next week. If the rain event is expected to miss key areas or lessen in strength, expect to see some weather premium pumped back into the market. Longs continue to add due to tightening balance sheets here in the United States.

SBM Highlights:

- Soybean meal futures continue to struggle to push over the $400 per ton threshold

- Market conditions in the soybean complex are leaning overbought, so a correction could be coming to reset the charts

- South American weather is supportive and being watched closely by the market this time of year

- Export sales of U.S. soybeans continue to be strong and are a driving force to higher prices

Market Quotes