December 2, 2022

Milk Markets Lower; Spot Products Mixed

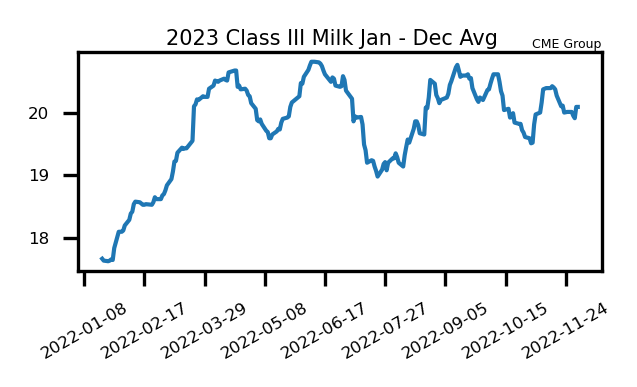

Class III January futures made a large turnaround as the price dipped to $19.37 and rebounded back to $20 by Friday, losing only 10 cents on the contract overall this week. Class IV January futures gapped lower on Monday and despite a small trading range for the week of only 4 cents, the contract was down 41 cents from last Friday’s settlement. Spot cheese followed Class III futures lower early in the week, then rebounded in later sessions to settle fractions of a penny under $2/lb, spot butter remains relatively rangebound the last two weeks and closed today near the bottom of the range at $2.90/lb, spot powder continues to trend lower with a settlement of $1.36/lb, while whey was nearly unchanged this week at $0.45/lb.

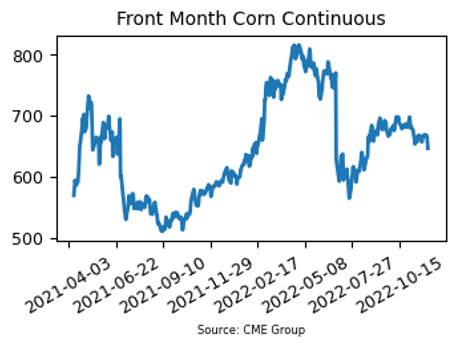

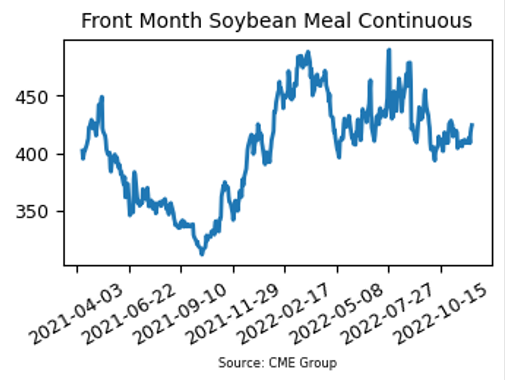

- Grains were mixed this week with corn and wheat under heavy selling pressure, while beans and meal were able to make gains; Exports and biofuels were the big fundamentals moving grains this week

- The US Dollar Index broke through support of 106 and has trended lower since multi-year highs were achieved in late September; Today’s settlement near 104.50 is the lowest weekly close since August 8th

- US weekly dairy cow culling for week ending November 19th was +1.9% YoY

Corn Hits 3-Month Low

- March corn futures fell to $6.4625 on Friday’s trade, down 25 cents on the week

- Slow US corn exports and a possible rail strike has had corn on the defensive again; Export inspections are down 6% from the 5-year average and down from 32% last year’s pace

- The European Union’s corn harvest is estimated to be 53.3 million metric tons, down from a previous estimate of 54.9 mmt and down about 27% from last year’s production

- Despite the back-and-forth on GMO corn to Mexico this week, a sale of 114,300 metric tons of corn to Mexico was announced on Thursday for the 2022/23 marketing year

- 448.9 million bushels of corn were used for ethanol production in October, down 4.1% from October of 2021

- StoneX estimates Brazil’s corn crop to be 130.3 million metric tons, up from 123.5 mmt last year

Soybean Meal Back Above $420/ton

- January soybean meal futures closed $17.80/ton higher at $424.10 this week

- While Brazil weather is mostly favorable, Argentina is fighting a hot and dry setup that is expected to prevail for most of December

- 197 million bushels of soybeans were crushed in the US in October, down just 0.1% from the same period last year

- Vegetable oil prices, including soybean oil, have fallen hard this week after disappointing talks regarding blend requirements

- StoneX estimates Brazil’s soybean crop to be 155 million metric tons, up 737k tons from last month and up 22% from last year

Friday’s Market Quotes