December 10, 2021

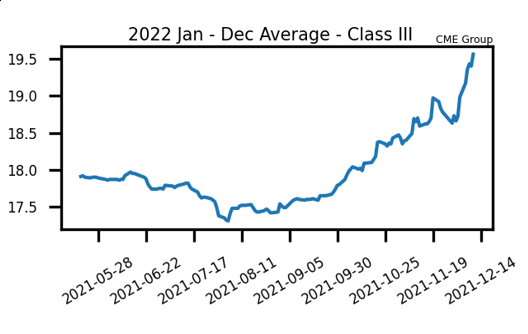

Another Strong Week For Milk

Class III milk futures capped off a strong week with $1.05 gains for the second month January contract while the 2022 calendar year average closed up 57 cents at $19.56. Some wariness on Class III potential from these levels is warranted with the second month contract testing long-term resistance at $20.00. On top of that, the block/barrel average has yet to break out of its 2021 range, although whey prices have been rallying. The wild card for Class III price potential is the Class IV trade, however, which saw the second month push to a new high of $20.35. Breaking the psychological $20.00 mark could open up the topside for that market as it continues to find support from its corresponding spot markets. The 2011 high of $20.90 is now in sights.

The Class III spot market trade saw cheese 4.25 cents higher this week to $1.7725/lb, 6.75 cents beneath its 2021 high. Four times so far this year, the second month Class III futures and spot cheese have failed around the $20.00 and $1.80/lb mark, respectively. Will those markets breakout or will this make a fifth occurrence? Whey prices pushed to a new high of $0.7125/lb this week after spending a good chunk of the last month mired around $0.70/lb. For Class IV, the big news is butter finding some buying above the $2.00 mark with a close at $2.1225/lb, up 12 cents on the week. Spot powder also pushed to a new 7-year high of $1.6250/lb. Outside of strong spot markets, overall support continues to stem from high feed costs, lower milk production growth, declining cow numbers, and strong exports.

Corn Adds 6c This Week

Corn futures had a pretty quiet week of trade overall, as the market continues to hold in a slow and steady uptrend. The March 2022 contract was green three days this week and closed red in just two sessions. Thursday’s USDA Supply and Demand report came and went without much volatility. In the report, the USDA showed no major changes to corn carryout, leaving the number at 1.493 billion bushels. This is the same level that was reported in the November report. The market had been looking for a number closer to 1.487 billion bushels, so the higher number put out by the USDA may have capped market trade this week. Demand remains strong with yet another good week of corn usage for ethanol production. Dryness over southern Brazil is causing some stress, though dryness in Argentina remains a concern for corn planting. We continue to target a correction in corn before recommending purchasing anything at this time.

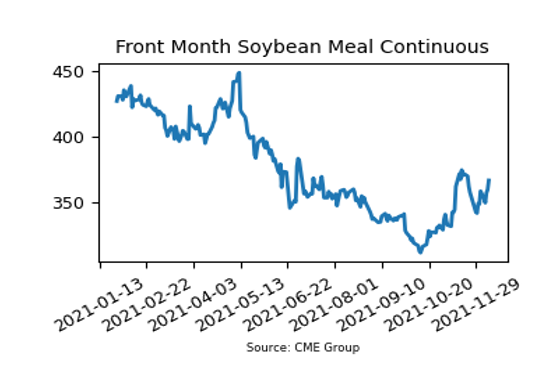

Soybean Meal Jumps $7.10 on Friday

Soybean meal futures surged higher in Friday’s session, adding $7.10 for the day as the January 2022 contract finished at $366.80 per ton. For the week, this puts soybean meal up $10.20 after rallying $11.50 during last week’s trade. Thursday’s Supply and Demand report showed that the USDA left carryout unchanged for soybeans and tightened the global carryout forecast. This supported higher prices in the bean complex. The USDA left their estimate for Brazil and Argentina’s soybean production unchanged from November at 144 and 49.5 million metric tons. Going into the end of the year, the market will stay extremely focused on demand and the weather trends for South America. Pressure on Friday stemmed from a weaker soybean oil trade.

Today’s Market Quotes