December 11, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

Milk

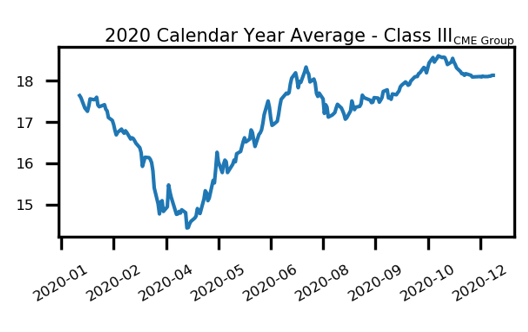

Class III milk futures had a strong week of trade, as the spot markets being to show signs of life. This month alone, the spot butter market is up 11.75c and powder is up 1.75c. Meanwhile, the spot cheese market is finally starting to stabilize a bit, holding right around $1.50/lb. Cheese has experienced a record amount of volatility this year bouncing between a low of $1.00375/lb and a record high of $2.7050/lb. The fact that the market is beginning to stabilize again is helping to support milk futures. This week’s trade saw January 2021 class III milk add 57c while February gained $1.03. On Monday, the USDA announced $50 million in butter purchases on the open market and $60 million in fluid milk purchases on the open market. This supported prices this week.

Milk Highlights:

Spot cheese is starting to base out around the $1.50/lb level, which is where buyers are starting to stabilize the market

A couple additional government dairy product purchases on the open market totaling $110 million helped support prices this week

Class IV milk has started to make some interesting price movements as butter and powder price action has become positive in the spot market recently

U.S. October dairy exports were strong, with help from a weaker U.S. Dollar this year

Corn

Corn futures recovered a total of 3c this week after falling 13.25c during last week’s trade. The market traded in a fairly tight range overall, with the March 2021 contract settling at $4.2350 per bushel. The market had a muted reaction to this week Thursday’s USDA Supply and Demand report. The USDA left United States corn ending stocks alone at 1.702 million bushels – which is the same as November. The USDA did lower world ending stocks to 289 million metric tons, down from the 291.40 number in November. There were a few corn export sales this week, which helped support prices. Export demand continues to be strong. South American weather is being watched closely, with temperatures over 100 degrees on Thursday in Argentina.

Corn Highlights:

Corn futures are consolidating a bit near highs. The market awaits a catalyst before taking prices higher

USDA corn export flash sales continue to roll in. There were a couple more announcements again this week

There is still a rumor that China may be looking to make additional purchases of US corn

The USDA lowered corn ending stocks in Thursday’s December Supply and Demand report

Soybean Meal

Soybean meal futures posted a second down week in a row, as the market continues to struggle after being rejected multiple times at the $400 per ton level. The front month January 2021 contract gave back $4.70 this week after falling $9.70 last week. Brazil is expected to get rains in the next 10 days, but the amount could be lighter than needed in the dry areas. Also, Argentine oilseed workers and grain inspectors continue to wage strike. In Thursday’s USDA Supply and Demand report, the USDA lowered United States ending stocks to 175 million bushels, which is down from the 190 million bushel figure from November. They also lowered world ending stocks to 85.60 million metric tons, down from 86.50 million metric tons the month before.

SBM Highlights:

Soybean meal futures were rejected at the $400 level and have now finished two weeks lower

Rain is expected in Brazil over the next 10 days. How much rain actually falls will be watched closely

The USDA lowered expected US soybean ending stocks by 15 million bushels on December’s report

Export sales of U.S. soybeans continue to be strong and are a driving force to higher prices

Market Quotes