December 16, 2022

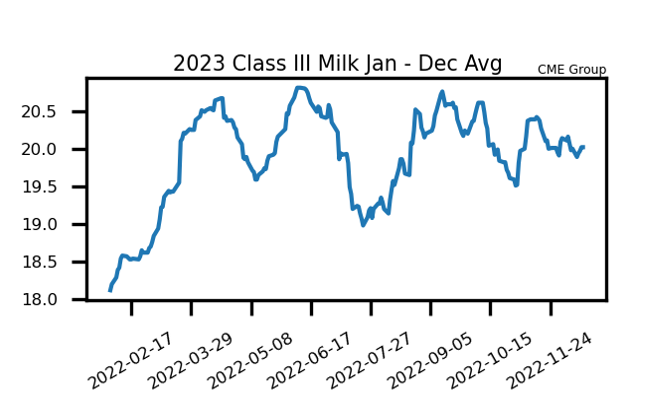

Class III Milk Red Fifth Week in a Row

Since peaking in November at $21.04, the January 2023 class III milk futures contract has fallen $1.80 over the past few weeks. Over that stretch, the market has closed red five weeks in a row. Pressure for dairy stems from a shaky spot cheese trade, consistently lower powder prices, and a softening corn trade. 2023 class III contracts still remain at elevated levels, in a range between $19.10 and $20.59, but that range has fallen $1 to $2 in the past couple months. The market will see a busy week of new data next week and the oversold nature of the market could create a turnaround on positive news. There is a US milk production report on Monday, a Global Dairy Trade auction on Tuesday, and a US cold storage report on Thursday. The milk production report from October had US production up 1.40% year-over-year and cow numbers up 42,000 head from a year ago. The market will watch to see how cow numbers look, because since May cow numbers have been mostly flat. The Global Dairy Trade will be watched closely with the GDT in the midst of a two-event upswing. The market will watch to see if buyers will continue to support higher global dairy prices.

- Fundamental reports next week: Monday- Milk Production, Tuesday- GDT auction, Thursday- Cold Storage, Friday- Cattle On Feed

- Dairy cow culling, compared to last year, down 4.6% as of December 3rd

- US grocery sales are well ahead of numbers from the last 10 years, cheese demand remains steady, curd demand is lower, butter demand is lower in the retail and food service markets

- Grains were mixed on the week, beans and bean meal were moderately lower, corn and wheat futures slightly up

Corn Market Recovers Back Over $6.50

- Front month corn futures closed the week up at $6.53, which is 9c higher than last week’s close

- National US corn basis remains the strongest in 20 years

- Dryness continues in Argentina and southern Brazil and is supporting grain prices a bit

- There is talk of a first quarter soft recession in the US due to higher interest rates, which may impact the demand for food and fuel

- The Buenos Aires Grain Exchange said corn planted in Argentina is 43% complete and the crop is rated just 18% good to excellent

- The corn trade has been choppy lately, but is still in a slight downtrend

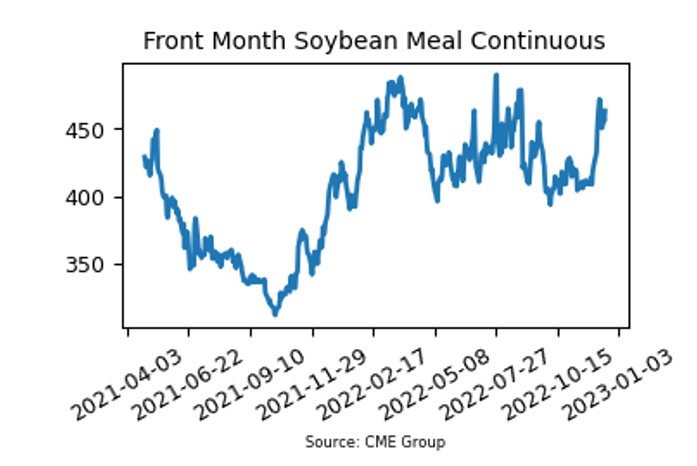

Soybean Meal Stays Elevated

- Front month soybean meal closed the week over $450 per ton for the second week in a row

- Overall, January ’23 bean meal fell $8.60 per ton to a $463.00 close

- US soybean commitments are up 4% from last year

- The Buenos Aires Grain Exchange said soybean planting in Argentina is 51% complete with the crop rated just 19% good to excellent

- November NOPA crush was 179.2 mb versus 181.5 mb expected

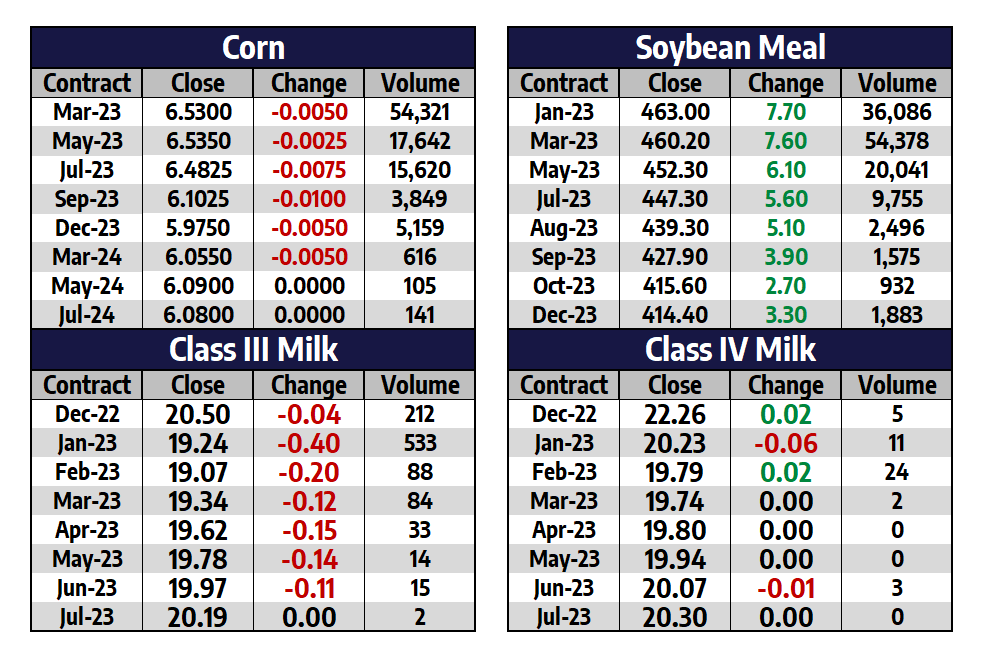

Friday’s Market Quotes