December 18, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

Milk

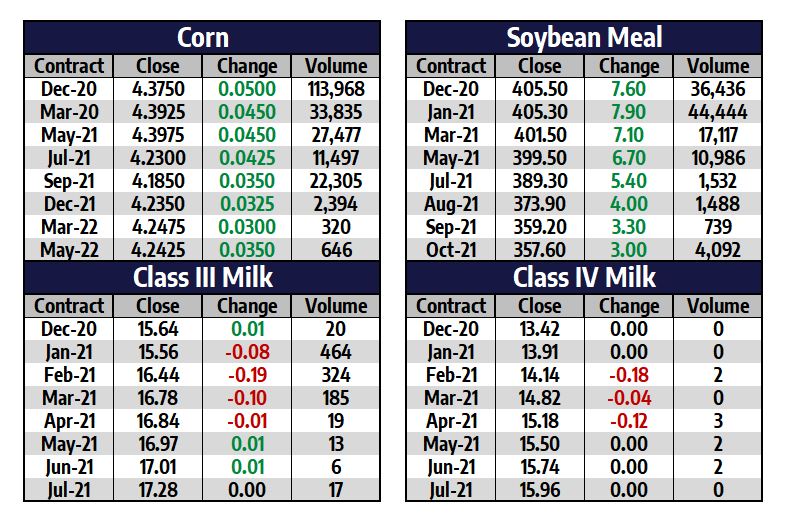

January Class III traded 60 cents lower on the week, and has closed down 7 of the last 8 weeks. On average, Class III milk prices in 2021 finished the week down 23 cents. While Class III prices had a volatile week, with two 75 cent limit moves since last Friday, the Class IV market remained quiet. Most Class IV contracts finished the week steady or slightly lower. Spot markets were mixed this week with cheese and nonfat gaining a little ground, while butter and whey struggled. This week the November milk production report showed that total US milk production grew by 3.0% year-over-year. That is a level of growth that has not been seen since 2014. US cow numbers continue to climbs the herd is now up 62,000 head yoy.

Milk Highlights:

January Class III contract has been down 7 of 8 weeks.

US milk production in November was up 3.0% yoy

US cow numbers are now up 62,000 head yoy

Corn

March corn closed up 14 cents on the week, and posted it’s highest weekly close since the week of July 8th, 2019. Since the August low the market as been up 15 out of 19 weeks. At today’s high the March contract got within a penny of the Nov 30th high of 4.3950. That level is current short-term resistance. A close over that high and the 2019 high of 4.6425 would be the next resistance. Yesterday’s export sales report showed a pick up in export demand from the prior week, with net sales of 1,924,488 mt vs 1,362,192 mt the week prior. Outside markets were supportive this week with the soy complex stronger, the US Dollar falling to fresh multi-year lows, and the stock market up into new record high territory.

Corn Highlights:

Corn market tested the November high this week

Net export sales jumped significantly over the prior week

Outside markets and tight supplies continue to support the market.

Soybean Meal

January meal closed over prior resistance of 402.40 and immediately tested the 2018 high of 406.50. Intraday the market pushed over that 2018 high, reaching a high of 408.20, before selling pressure knocked the market back below that high at the close. For the week, January meal was up 25 dollars per ton, ending a two week slide. Net export sales of soybeans picked up over the prior week with 922,266 mt vs 569,000 mt the week before. The pace of sales over last year is starting to slow a little bit as total export commitments were up 952 mil bushels yoy last week, and up 933 mil bushels yoy this week. Moisture conditions have improved in Brazil overall this month, as many areas have received rainfall since the first of the month, yet more rainfall will be needed as the earliest planted acres start to enter the reproductive stage. Above normal temperatures remain in the 6 to 10 day forecast. This week it was reported that bean conditions in the major producing state of Parana were 72% good.

SBM Highlights:

Soybean meal closed at fresh multi-year highs this week.

US weekly export sales of soybeans increased significantly from the prior week.

Despite recent rainfall, weather in Brazil remains a concern as the reproductive stage of growth nears.

Market Quotes