December 24, 2020

Milk

Class III milk futures had yet another extremely volatile week of trade. The big news of the week this week was that Congress had approved a COVID stimulus relief bill that included $400 million in fluid milk purchases on the open market. This helped to push milk futures limit higher on Tuesday with some follow through on Wednesday. The market is still digesting the news, however, as President Trump made it sound like he is still unhappy with the bill in its current form. He would like to see stimulus checks increase from $400 per individual to $2,000 per individual. This now brings the idea that Congress may not reach a deal if neither side budges. We’ll continue to monitor. January 2021 class III milk is up $1.46 per hundredweight this week to $17.02.

Milk Highlights:

The spot cheese block/barrel average market jumped 5.50c so far this week.

In the most recent draft of the COVID Stimulus bill, the government has set aside $400 million for milk purchasing on the open market to then be donated.

Nearby class III milk futures were limit up in 6 months during yesterday’s trade.

Class III milk still holds a significant premium over the class IV market.

Corn

Corn futures posted yet another green day again on Wednesday, as the streak of up days continues. The streak is now up to 9 consecutive days, with March 2021 corn adding 3.75c to $4.4725 per bushel. The market was able to shake off a poor export sales report. Corn export sales were 651,000 metric tons, which was down 66% from last week. Argentina’s weather forecast trended a little wetter today, but is still too dry overall. Ethanol production for the week ending 12/18 averaged 976,000 barrels per day. This is down 9.88% from last year. For the week so far, corn has gained 10.75c. The market is up 22.25c so far this month.

Corn Highlights:

Corn futures have closed higher for nine consecutive sessions.

Forecast weather models have turned Argentina’s upcoming weather a little wetter. Conditions still remain dry though.

Weekly ethanol production for 12/18 was down 9.88% from the same week last year.

Corn export sales this week were 651,000 metric tons.

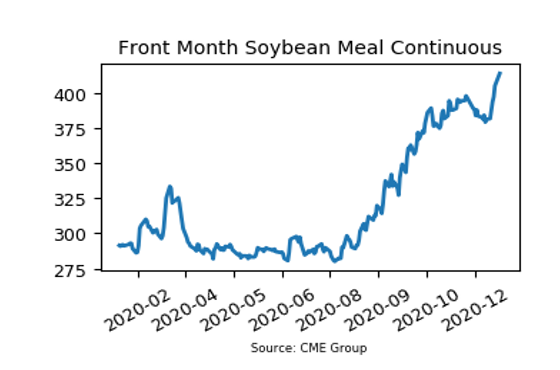

Soybean Meal

Ever since the market broke through the $400 per ton barrier, soybean meal futures have continued to be strong. Today’s trade saw the January 2021 contract add another $6.20 to $421.20. This was the ninth up day in a row for bean meal. The funds continue to be net buyers of the market. Brazil experienced some rainfall recently. Although, there are still ongoing wage talks between Argentine pork workers and soybean manufacturers. This is slowing down South American exports at this time – marking the 13th day of the strike. Export sales this week for soybeans were 352,000 metric tons – down 62% from last week.

SBM Highlights:

Soybean meal has finished higher for nine sessions in a row as the market pushed through the $400 resistance level.

Brazil has experienced some rainfall recently, but conditions still are too dry at this time.

Export sales for soybeans this week were down 62% from last week. This is something to monitor moving forward.

The funds hold a strong net long position in the market and continue to add to it.

Market Quotes