December 30, 2020

Milk

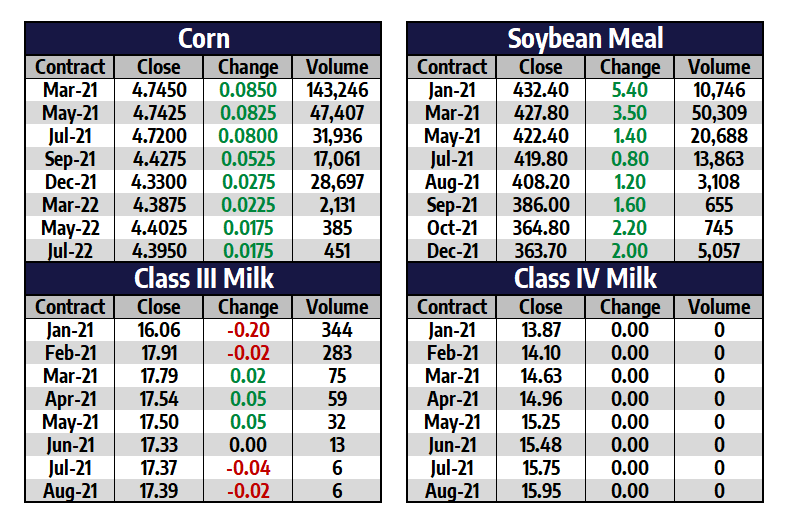

Class III milk futures pushed slightly higher this week with the February 2021 contract up 24c to $17.93 through Wednesday’s trading session. The market is still working through updates from the government that $400 million was set aside in the most recent COVID stimulus relief bill to purchase milk on the open market. Participants are still awaiting further details on this, but the fact that President Trump has signed the bill now makes it a law. The government continues to intervene in the market and should help to support prices at least for the near future. The 2021 class III milk average is currently at $17.34, up nearly 80c from its November low. The spot markets are still pretty quiet overall, but cheese prices are starting to distance themselves from the $1.50/lb mark. On Wednesday, spot cheese closed up at $1.57375/lb. Class IV milk remains in a struggle, with contracts well below that of class III.

Milk Highlights:

The spot cheese block/barrel average market still holds above the $1.50/lb mark. It closed Wednesday at $1.57375/lb.

In the COVID Stimulus bill, the government has set aside $400 million for milk purchasing on the open market to then be donated.

The rallying feed market and weaker United States Dollar are also supporting the milk trade

Class III milk still holds a significant premium over the class IV market.

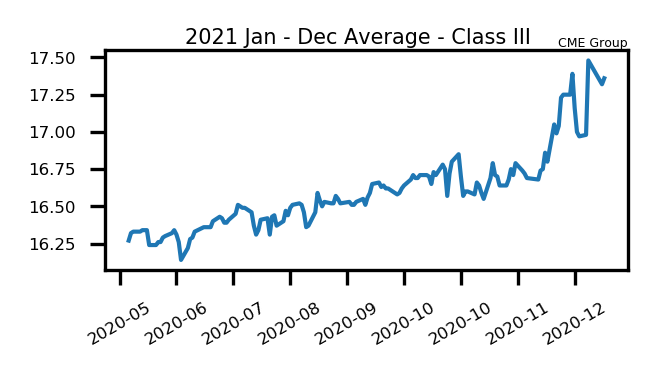

Corn

Corn futures have now pushed higher for thirteen session in a row. The fact that Argentina weather is staying overall drier is keeping the market supported. The March 2021 corn contract is up 23.50c so far this week through Wednesday, tacking on 8.50c today alone. Today’s settlement came in at $4.7450 per bushel, which is starting to get within striking distance of the $5.00 threshold. Global demand and a lack of farmer selling is also helping to boost prices. Talk of China purchasing additional United States corn is supporting. Some caution could be had moving forward, though, as ethanol demand was lower than last year and ethanol stocks are building. There is also rain expected for Argentina and Brazil in the forecast.

Corn Highlights:

Corn futures have closed higher for an impressive thirteen consecutive sessions.

Global demand for U.S. products, a lack of farmer selling, and weather concerns in South America add support

Ethanol stocks are building and demand is less than it was a year ago

There is rain expected for Argentina and Brazil in the coming days

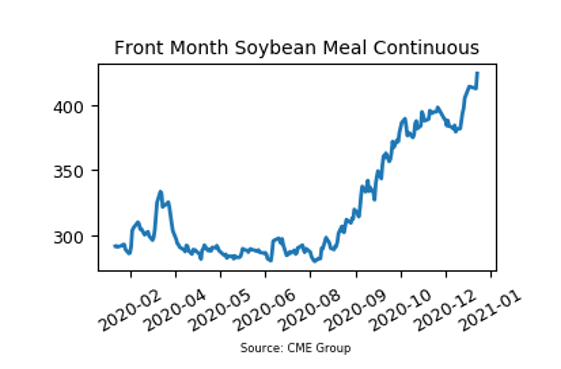

Soybean Meal

Soybean meal futures have rallied another $15.60 per ton this week with the March 2021 contract closing Wednesday at $432.40. The market continues to be overbought and some are looking for a correction, but for now prices continue to work higher. Overall, rains in South America continue to support crops favorably while Argentina remains dry. The fact that supplies here in the U.S. remain tight is supporting. The U.S. Dollar continues to weaken as well, continuing to make the U.S. bean market competitive on a global scale. The United States is the only significant source of soybeans currently and there is talk that China is looking for February delivery for soybeans. The National Soybean Index closed at a six-year high today.

Soybean Meal Highlights:

Soybean meal pushed up into new highs for the move on Wednesday as the uptrend continues

Market conditions are leaning overbought, so a correction could be coming. However, news remains bullish at this time

More rumors are floating around that China is looking to buy beans from the U.S. for February delivery

The funds hold a strong net long position in the market and continue to add to it.

Market Quotes