December 30, 2022

Dairy Markets Mixed for the Week

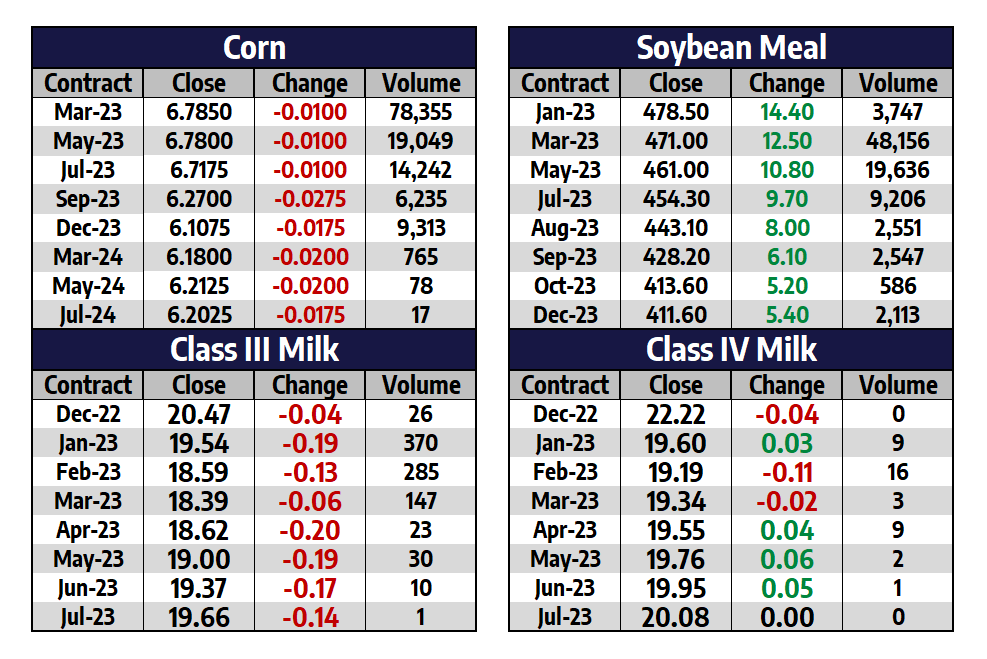

The dairy markets were mixed this week with front month Class III milk futures slightly higher and Class IV milk slightly lower. The 2023 class III milk average was down over 15 cents to settle at $19.38 while the 2023 class IV average settled at $19.98, down a nickel for the week. Dairy products moved in opposite directions as spot cheese gained 3 cents to $1.99/lb, butter was down a penny to $2.38/lb, powder barely made gains up a half penny to $1.335/lb, and whey broke back above support with a 3 cent gain to $0.415/lb. There was very little fundamental news this week so the spot trade dictated a lot of the price action. Next week there will be a Global Dairy Trade auction on Tuesday, dairy exports on Thursday, and a Dairy Products report on Friday. High feed costs continue to support milk while a weaker spot market trade is adding pressure.

- There were reports this week that milk is widely available for Midwestern cheesemakers. Some loads are offered at discounts as low as $10 under Class

- Spot whey found support after hitting a new low of year last week at $0.3650/lb. It closed this week 5c higher to $0.4150/lb

- Milk futures are now in a downtrend as the market has been pressured lower from a weaker spot trade

- Class IV milk still holds the edge on class III for most contracts despite a steadily declining butter trade

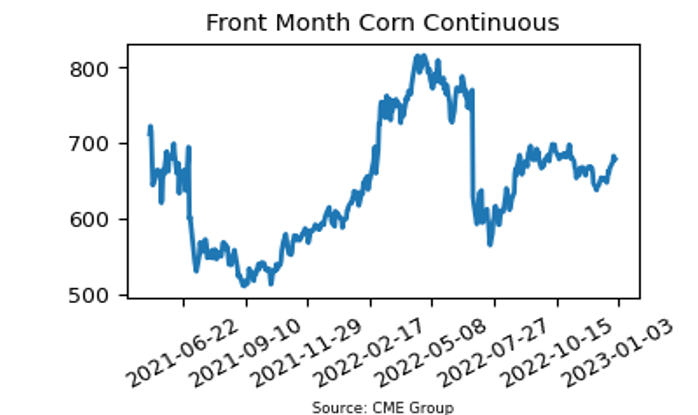

Corn Closes the Year Strong

- March corn futures finished the year up three weeks in a row and gained 34.50c over that stretch

- Front month corn futures were up 12 cents per bushel this week to a $6.785 per bushel close on Friday

- Heavy rains are forecast to fall around the Mississippi River tomorrow and into next week which should help water levels and barge traffic

- Corn basis remains historically high even though exports and ethanol demand is slow and is most likely due to producer’s unwillingness to sell

Soybean Meal Adds Another $19.70 This Week

- Front month bean meal futures surged higher on Argentinian planting delays and weather concerns, up nearly $20 per ton to $471.00

- The trade is watching South American weather closely and while Brazil is sitting pretty, Argentina may have chances for rain this weekend

- Indonesia’s president sad he will announce a commodity export ban which may include palm oil, which holds the world’s largest share of the veg oil market

- Crush margins remain very profitable with the value of crushed beans exceeding uncrushed beans by 3.31 per bushel based off March futures

Friday’s Market Quotes