August 28, 2020

We strive to assist farmers in better managing their revenue and helping them gain back control. If you have clients that need professional consultation and guidance, please get me in touch with them. As a leader in this industry, Total Farm Marketing can help your clients implement and manage a range of marketing tools, such as Milk Plant & Elevator Contracts, Hedging Tools, and D-RP. We know that every operation’s needs are unique, so we provide assessment consultations, webinars, group presentations, education, and individual management consultations to help meet their goals. Find resources here: Webinars & Events

Together, let’s work to keep these dairy men and women in the game.

Contact: Michael Rusch

Sales Director | Total Farm Marketing

Direct: 262.438.0323 | Text: 262.334.9779 | Email: Mike@TFM.ag

Milk

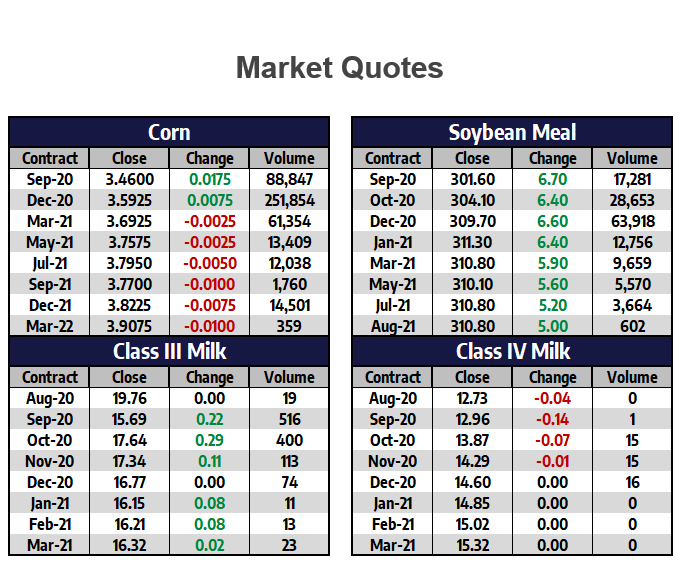

President Trump announced earlier in the week that the government would purchase another $1 billion worth of commodity products for the food for families program. This took the dairy market by storm. Cheese buyers initially rallied the cheese market on this news with the block market up 22.25c from Monday through Wednesday. The buying pressure faded a bit throughout the rest of the week, though, but cheese still finished the week up 13.875c. September class III milk recovered 57c and posted a $15.70 close for the week. October gained $1.39 and closed up at $17.72. Market conditions are pretty mixed at the moment for dairy.

Corn

December corn futures posted another strong week of gains, rallying for the third week in a row. Price action saw the contract work up to a $3.5925 per bushel close, which is up 18.75c. The market reacted positively to a 5% decline in corn crop ratings on Monday and additional weather updates throughout the week. There is a lot of uncertainty over the quality of corn that will come out of Iowa, especially after the derecho storm hit. There is also talk that the state is being hit by its most widespread drought in seven years. Rain is expected this weekend in both Iowa and Illinois, but the amount expected has been downgraded significantly. A lack of rains this weekend could lead to a gap open on Sunday night.

Soybean Meal

December soybean meal futures jumped $12.20 per ton this week, posting its largest weekly gain since late June. The settlement for the week comes in at $309.70 per ton, which is its highest finish since late March. The meal market is receiving a lot of support from a rallying corn and soybean market. The big story this week was that Brazil removed import tariffs on soybeans due to tight supplies. This could open up an additional buyer of U.S. soybeans. Additionally, the market is watching weather as hurricane rains in the southern states could create moisture issues. Although, rain forecasts in the Midwest are becoming milder for the weekend in areas that need rain. The funds have been large buyers of beans in recent sessions.