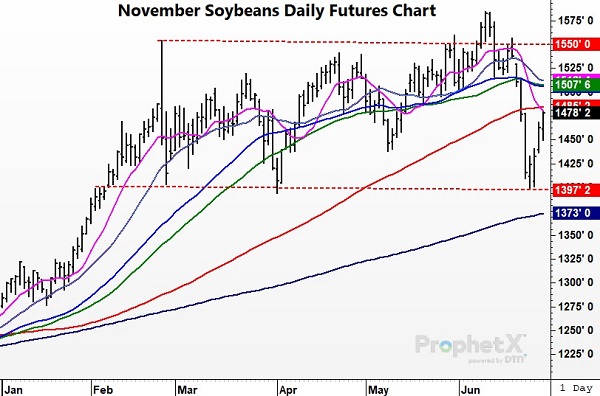

SOYBEAN HIGHLIGHTS: Soybean futures managed another solid day of gains. Higher meal and oil helped, but traders are likely focused on, and positioned themselves in front of tomorrow’s reports. July soybeans gained 10-1/2 cents, closing at 16.74-1/4 and Nov ended the session 15-3/4 higher at 14.78-1/4.

Despite little fresh news ahead of tomorrow’s reports and weakness early on, soybeans again showed strength by the close. Higher meal and oil were again supportive to beans with meal gaining 9.60 in the August contract. So far, the news of China relaxing quarantine restrictions has not been met with new demand, but that is still the expectation. There are rumors of China purchasing Brazil soybeans for August this week. Tomorrow’s reports are still the main item on trader’s minds, however, and could still possibly show near record soybean seedings (so the strength seen the past few days is impressive). Pre report estimates show an average guess of soybean stocks at 959 mb, compared to 1,931 mb in March and 769 mb at this time last year. As far as acreage, the average estimate is pegged at 90.43 million acres, compared with 90.96 million in March and 87.20 million last year. Due to the poor conditions in North Dakota and Minnesota this year, traders will also be keeping a close eye on prevent plant acres in that region. Once the report is over, the market will likely go back to trading weather, and the extended forecast still calls for heat and dryness throughout most of the Midwest.

SUMMARY:

Soybeans finished higher for the fourth day in a row, but tomorrow’s reports have the potential to cause wide swings and are the main thing the market is focused on right now. Momentum continues upward from a technical perspective, but again, volatility is a concern. After dust settles tomorrow, the market will focus on the weather forecast. Get current with recommendations if behind.

SOYBEAN PRICING STRATEGY:

HEDGING: 2021: Aside. Recently, Jul futures purchased at 16.84-3/4 was exited at 16.45-1/4 on 25%. Recently long May from 16.00 was exited at 17.06 on 25%. 2022: 20% hedged Nov, 10% at 14.68-3/4 and 10% from 15.33-3/4. No exit strategy currently.

CASH: 2021: 90% sold. Most recent sale is 5% when May closed below 16.75. Filled near 16.64-1/4. 2022: 55% sold. Most recent sale: 5% sold Nov at 15.50. 2023: 25% sold. Recently sold 5% on a close below 14.00 Nov, filled near 13.92-3/4.

OPTIONS: 2021: On 25% bought Sep 15.80-17.00 spread for a difference of 33 cents. Hold. Recently, on 25%, a Jul 14.20–15.60 bull call for a spread for 39 cents was exited at 1.35-1/4. Recently, on 25% Mar 14.00 calls bought at 17-5/8 were exited at 1.92-1/8. 2022: On 25%, hold bought 14.00 puts for 79 cents and sold 16.00 calls for 70. (This is a defensive strategy for new crop expected production) On 25% bought Nov 15.00 calls and sold Nov 17.00 calls to cover cash sales. Filled at a spread difference of near 79 cents. (This is an ownership position for soybeans that are forward sold).