Corn market posts setback this week

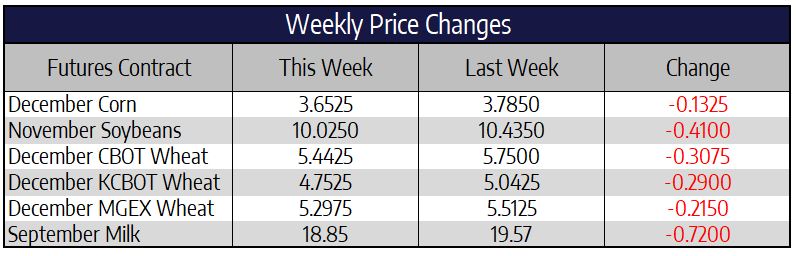

December corn futures were 13-1/4 cents lower this week to close at 365-1/4. After spending a majority of the summer in the deep depths of sub $3.40 corn it can look as if the tide has turned seeing $3.65 corn heading quickly into harvest. While the welcome higher prices are a sight for sore eyes fundamentals must still be taken into consideration. With a currently projected 2.5-billion-bushel carryout and 17% stocks to use ratio, the corn market faces some of its worst fundamentals since 2005. While recent and hopefully continued record corn buying from China should help, these increased exports are already figured into the USDA’s balance sheet. Lasting impacts and continued potential impacts from COVID-19 have beat up the ethanol industry which continues its attempt to crawl back to normalcy. With the corn market being overbought heading into harvest, speculative buying may look for a more significant break in prices to add long positions.

Dryness continues to become more of an issue by the day in South America. Soybean planting is being delayed due to dryness in Brazil. The dryness is still lingering from below normal precipitation in some areas last year. Delayed soybean planting will push back second crop corn plantings following soybean harvest in early 2021. Dryer weather patterns in South America are not uncommon during La Nina influenced years. Comparable years for the US such as 2017 saw drought in the Southern Plains. Dryness from a lack of summer rains in 2020 could linger into the growing season of 2021 sparking drought concerns.

Soybeans retract but close above $10

November soybean futures lost 41 cents this week closing at 1002-1/2. This was the worst week for front month soybeans since early March. Even with record weekly export sales, November soybeans tumbled this week closing four straight sessions lower. The outlook for great harvest weather plus commercial (farmer) selling this week added fuel to the fall lower. Chinese demand news looks to have taken a back seat to harvest pressure at least in the short term. For the USDA quarterly grain stocks report for release next week, traders see soybean stocks on September 1st at 576 million bushels, as compared with 909 million bushels last year. Slight yield reductions to the USDA soybean balance sheet could significantly tighten ending stocks if export sale commitments follow through to shipments. It is still early in harvest, but yield reports have been mixed to better than expected in some areas.

After a steady slide lower in the last four months the US dollar showed some signs of life this week recovering back to mid-July levels. With the November election approaching on the horizon the continued volatility in the dollar is likely. Thursday morning was the first morning since September 2nd without a daily sale announcement from the USDA. Going all the way back to August 1st there have been just 5 days without a daily sale announcement from the USDA. China has been front and center for a vast majority of these sales. So far in the 20/21 marketing year export sales of soybeans are at 35.5 million tons up 192% year over year. Chinese soybean imports are up 15% year over year and are nearing the 65-million-ton mark.

Wheat gives back last weeks gains

December Chicago wheat futures lost 30-3/4 cents this week to close at 544-1/4. December KC wheat futures lost 29 cents this week to close at 475-1/4. December spring wheat futures lost 21-1/2 cents this week to close at 529-3/4. All three wheat contracts gave up nearly all of last week’s gains and also closed near their lows for the week. Drought covers 26% of the US winter wheat production area according to the latest drought monitor. Large sections of the high plains have welcomed the dry weather to complete fall field work, but rain will be needed in drought-affected areas for proper wheat establishment. For the USDA quarterly grain stocks report for release next week, traders see wheat stocks on September 1st at 2.242 billion bushels, as compared with 2.346 billion last year. For the wheat production estimates, traders see all wheat production at 1.841 billion bushels, as compared with the August USDA estimate of 1.838 billion bushels.

Cheese Prices Choppy On the Week

On Friday, the spot cheese market was able to trade higher in blocks and barrels to finish at $2.1075/lb. Blocks continue to lead the way at $2.555/lb vs. barrels at $1.66/lb. Blocks finished lower on the week to drag the average down as the spread between the two products narrowed slightly from $1.00/lb to $0.90/lb. The up day in barrel prices today may indicate the possibility for barrels to close some of the difference to the upside. The butter market was the biggest loser this week dropping 9.5 cents after trading over $1.60/lb for the first time in months. Sellers were quick to push prices lower as butter finished the week at $1.5025/lb. Whey prices are approaching the 2020 high of $0.405/lb finishing the week at $0.3775/lb. Powder looks to be on a legitimate break out finishing the week up 3 cents at $1.10/lb. The next level of resistance lies at $1.15/lb.

The July to December average finished the week at $19.27 vs. $19.40 last week. Futures had a massive drop in the October contract of over $1.20/cwt in a single day this week. But on Friday prices rebounded 73 cents to make up for a lot of what was lost. With the spread between blocks and barrels so wide we expect to see a continuation of very high volatility in the milk futures market. Class IV prices are in a tug of war between rising non-fat powder prices and dropping butter prices currently. A larger breakout in powder may facilitate higher Class IV prices.