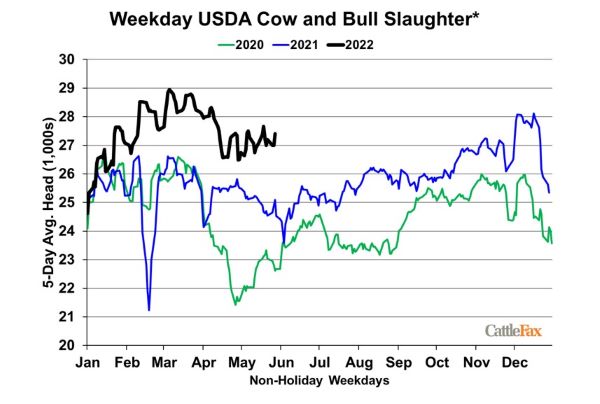

The pace of beef cow slaughter will stay supportive of cattle prices well into 2023. For the month of May, cow and bull slaughter remains historically large, averaging 145,000 head/day. This is nearly 2,000 head/day more than the month of April, as producers continue to move cattle out of their operations. The drought conditions in the southern Plains, the impact of high input costs and tight margins weigh on the cow/calf sector of the beef industry. In addition, elevated heifer slaughter through May indicates the fewer heifers are being retained as replacement females. This sets up a longer-term picture that should show tighter cattle supplies as the reduced breeding herd and beef cow inventory will impact the 2023 and 2024 calf crops, which will lead to tighter supplies going forward.

Like what you’re reading?

Sign up for our free daily TFM Market Updates and stay in the know!

CORN HIGHLIGHTS: Corn futures found some buying interest after the pause session with futures gaining 5 to 8 cents, yet it was short-lived with futures turning negative in the front months. July corn lost 1 cent closing at 7.30-1/2, while December gained 2-3/6 to end the day at 6.94-1/4. Generally conducive growing conditions and a somewhat benign weather forecast keep prices in check. Firmer soybean and wheat prices provided support, yet it was not enough to keep corn futures firmer. Export sales are to be released tomorrow instead of today due to Memorial Day on Monday pushing reports back one day.

Corn futures are at a critical pivot point. On the one hand, there is plenty of room for prices to move lower, especially if funds continue to drop contacts. On the other hand, when the market drops in fast fashion as did this week, there may be plenty of buyers just waiting to bounce. Bottom line as weather goes, so do prices. The rain makes grain crowd has to be of the mindset that the crop is basically in the ground, receiving moisture, and unless there is some other news, prices decline. At 108 mb, last week’s corn used for ethanol was a favorable and supporting number. Stocks of ethanol dropped rather significantly to 23 million barrels, or down 3.2% in a week, a sign of strong driving this past week. Firming crude is supportive yet was not reflected in today’s trade.

SOYBEAN HIGHLIGHTS: Soybean futures closed higher today with higher crude, reports of a soybean sale to Pakistan, and the possibility that fewer bean acres are going in compared to corn. July closed just 19 cents from its contract high. Jul soybeans gained 39 cents, closing at 17.29-1/4, and Nov gained 26-1/2 cents at 15.41-3/4.

Soybeans continued their show of strength today in addition to a solid jump in both soybean oil and meal. Demand just will not quit with July now at a 70-cent premium to August. Demand for soybean oil remains high as the Energy Department showed that 908 million pounds of soybean oil were used to make biofuels in March, the second highest monthly total on record. Wednesday’s Fats and Oils report from NASS showed 180.9 mb of soybeans were crushed in April, up 6% from a year ago. Private exporters reported sales of 352,000 metric tons of US soybeans for delivery to Pakistan, and China returned to buy 4.85 million bushels of US soybeans on Wednesday split evenly between old and new crop. China has also announced that they will sell 500,000 tons of soybeans out of their reserves on June 10. With the way the markets are looking, there is a feeling that fewer soybean acres will be planted than corn; corn futures have been battered by fund selling, and soybeans have been relatively immune.

WHEAT HIGHLIGHTS: Wheat futures posted modest gains today. There is not much fresh news to report, but it appears the funds may be done selling for the time being. July Chi gained 17 cents, closing at 10.58-1/4 and Dec up 17-1/4 at 10.81. July KC gained 15-1/4 cents, closing at 11.43-1/2 and Dec up 15 at 11.60.

Wheat managed to stop the bleeding today. Though the recovery was not equivalent to the losses of the past couple days, it may be the start of a correction to the upside. There is not much fresh news pertaining to wheat, but there is still the bearish possibility that Russia will allow Ukrainian grain exports. This is a point of contention though, as many do not believe Putin will allow this to happen without sanctions lifted. Essentially, he has put the ball in the court of the US (and other countries backing Ukraine). Many people do not believe that sanctions will be lifted, but if they are, there is about 22 mmt of old crop wheat in Ukraine that could be shipped. In other news, Egypt made a purchase of 465,000 mt of wheat, with Russia, Romania, and Bulgaria listed as sources. There is also still talk that India could become a net importer with only a small amount wheat shipped since their ban was implemented. Some projections for their crop are now below 95-100 mmt when it was previously estimated that their crop could reach 111 mmt. An intense period of heat and dryness greatly affected their crop. In terms of weather the US two-week weather forecast is mostly normal. Over the next few days there may be some drying in North Dakota, but rains will likely return next week. France and Germany could also see some scattered showers which would help the dry soils there.

CATTLE HIGHLIGHTS: Both live and feeder cattle closed higher today; light cash trade was steady with yesterday’s 135. Weakness in July corn helped the cattle complex again today. June cattle finished 0.825 higher to 133.625, and Aug live cattle were 1.225 higher to 134.125. In feeders, Aug gained 3.225 to 172.950.

Live cattle performed well today with the deferred months leading the way, and Dec cattle gaining 2.150 to close at 145.900. Feeders took another opportunity to rip higher as corn closed slightly lower despite wheat and soybeans showing strength. Feedlots may have greater resolve to hold for steady to higher cash with lower corn and higher futures. August feeders closed above the 50-day moving average for the first time since late February, and funds are getting caught short and needing to cover. The moves higher in both fats and feeders these past two days are indicating that a seasonal bottom is likely in place. Boxed beef was mixed this afternoon with choice down 0.77 at 266.65 and select 0.72 higher at 249.63. Boxed beef may trade sideways for a while as inflation impacts consumer spending. Weekly export sales were delayed due to the holiday weekend and will be out tomorrow. Bullish export numbers will give the cattle market a well-deserved boost after being undervalued for so long.

LEAN HOG HIGHLIGHTS: Hog futures finished mixed mostly higher as a strong move in retail values helped support the market. Prices faded going into end of the session on profit taking before the weekend trade and weekly export sales. June hogs finished 0.250 higher to 110.050, and July hogs slipped 0.250 to 112.175.

The July hog contract started the session strong but ran into resistance at the 50-day moving average at $113.500. The July contract hasn’t traded over the 50-day since April 22, and this moving average has acted as a swing point in the market. The 100-day moving average is acting as support, but a break above the 50-day could open the market to challenge trend line resistance near $118.000. The cash market has been supported under the hog futures. Midday direct trade was 0.96 higher with the weighted average price at 113.85 on Thursday, and the 5-day average moved lower to 111.77. The CME Lean Hog Index slipped 0.24 to 104.91. The June contract is limited by its premium to the cash market, trading at $5.140 premium on Thursday. Pork carcass values have been strong to start the week, and at midday on Thursday, carcass values surged 4.19 higher to 114.21. Movement was good at 153 loads. Product movement has been good recently, and the USDA will release export sales numbers on Friday morning before the market open. The CME Pork Cutout Index gained 0.37 to 107.84. After a difficult start to the week, hog futures are trading slightly higher for the week and $4-5 off the early week lows. Strong resistance over top limited gains on Thursday, but prices, with the support of good fundamentals are looking to extend the rally.

DAIRY HIGHLIGHTS: Class III futures were mixed today with most 2022 contracts closing with small gains. The July contract, now taking its spot on the second month chart, closed at $24.73, compared to the 2014 high of $25.30 and the all-time high from April at $25.79. The block/barrel average was down 1.3750 cents today to $2.26125/lb, marking seven lower closes in the last ten trading days. The divergence between Class III futures and spot cheese in recent weeks is a cause for concern, although milk prices likely finding a buoy given the Class IV strength. Most quarterly averages and individual contracts are testing their previous highs, making for an exciting start to the new month in the coming trading days.

Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of the National Futures Association. Stewart-Peterson Inc. is a publishing company. SP Risk Services LLC is an insurance agency. A customer may have relationships with all three companies. TFM Market Updates is a service of Stewart-Peterson Inc. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition.