USDA Quarterly Stocks Number Supports Trend Higher

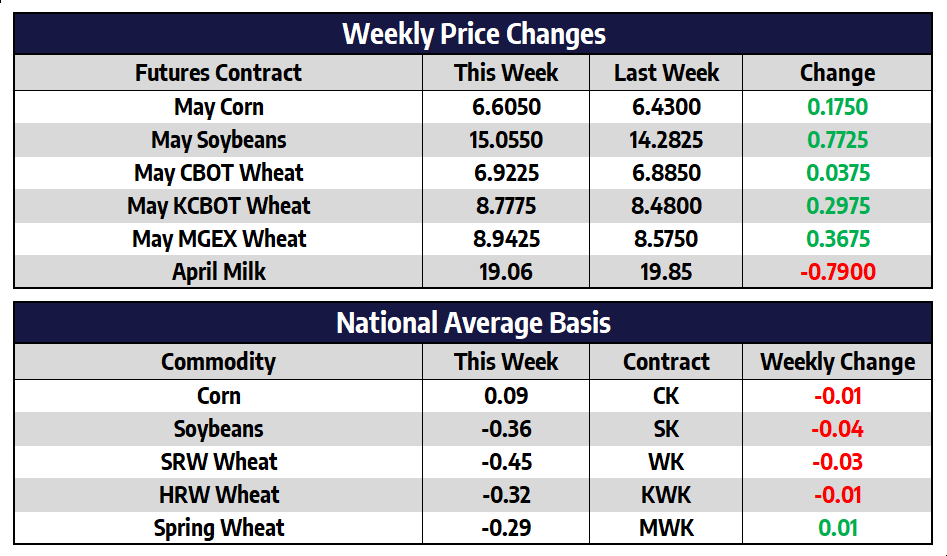

- May CBOT corn futures added 17-1/2 cents this week to close at 660-1/2.

- December CBOT corn futures added 6-1/4 cents this week to close at 566-1/2.

- US farmers are expected to plant 4% more corn acres in 2023 versus last year. 40 of the 48 reporting states are expected to see corn acres unchanged or increased from last year.

- The state forecast for the largest increase in corn acres year over year is North Dakota, adding 800,000 corn acres from 2022. With a cool and wet two-week outlook and current above-normal snowpack, many feel this forecast increase may already be in jeopardy.

- United States corn stocks on hand as of March 1, 2023, came in at 7.401 billion bushels, 69 million bushels lower than the average pre-report analyst estimate and 357 million bushels below stocks as of March 1, 2022.

- Safras & Mercado, a private firm in Brazil increased their estimate for the 2022/2023 Brazilian corn crop today. They now estimate the entire Brazilian corn crop at 130.3 million tons versus 125.3 million tons in their previous forecast.

Soybeans Erase Monthly Losses, Close Back Above $15

- May CBOT soybean futures added 77-1/4 cents this week to close at 1505-1/2.

- November CBOT soybean futures added 46-1/2 cents this week to close at 1319-3/4.

- United States soybean stocks on hand as of March 1, 2023, came in at 1.685 billion bushels, 57 million bushels lower than the average pre-report analyst estimate and 247 million bushels below stocks as of March 1, 2022.

- US soybean acres are forecast by the USDA to be nearly unchanged from last year at 87.5 million acres in 2023. This was slightly below where analysts estimated soybean acres prior to the release of the report.

- With soybean production in Argentina expected to be the lowest in two decades, soybean crushers in Argentina may need to import as much as 10 million tons of soybean in 2023, much of this supply is expected to come from Brazil’s potentially record crop.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Spring Wheat Acres Projected Lowest On Record

- May CBOT wheat futures added 3-3/4 cents this week to close at 692-1/4.

- May KCBOT wheat futures added 29-3/4 cents this week to close at 877-3/4.

- May MGEX spring wheat futures added 36-3/4 cents this week to close at 894-1/4.

- According to today’s report, US farmers significantly increased plantings of winter wheat for 2023 versus last year, adding over 4.2 million acres. Winter wheat acres at 37.5 million planted acres is an 8-year high.

- Compared to last year spring, wheat acres are expected to be down by 265,000 acres at 10.57 million acres. This was 380,000 acres lower than the average analysts estimate prior to the report.

- News that Cargill will end shipping of Russian wheat as of May 31 and Russia’s potential abandonment of the new Black Sea grain deal after 60 days helped rally wheat futures this week.

Milk Markets Sour on Friday

Nearby Class III prices took a sharp turn lower during today’s trade with Class IV prices, again, staying fairly stagnant. After being rejected for the second straight week at $20 on the second month contract, April futures dropped 36 cents during Friday’s trade and 88 cents lower overall on the week. May and June Class III futures were also considerably lower today as well, with losses of 14 and 13 cents, respectively, during Friday’s action. Class IV price action for the second straight day was fairly sideways, only seeing the March contract higher and losses contained to the last four months of 2023. Much of the price action today can be attributed to additional downward pressure in the spot cheese market, giving up over 7 cents per pound today on nine loads traded and over 20-cent losses throughout this week’s trade. We saw the spot cheese market for four consecutive weeks, breaking the $2 per pound threshold last week, only to give up a majority of those gains in this week’s trade. Spot butter has seen range bound trading for the majority of 2023 with most weeks ending close to $2.30-2.40 per pound.