Corn Slightly Higher on the Week

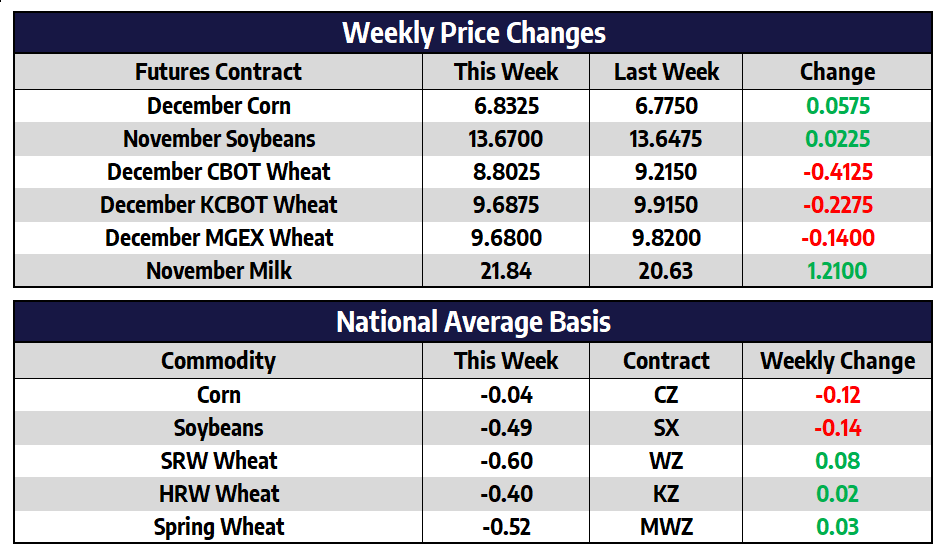

- December CBOT corn futures added 5-3/4 cents this week to close at 683-1/4

- July of 2023 CBOT corn futures added 8-3/4 cents this week to close at 687

- The USDA is scheduled to release its October World Supply and Demand Estimates next week Wednesday, traders see corn yield coming in at 172.1 bushels per acre versus the USDA’s 172.5 estimate in September

- Cumulative corn export sales have reached 23% of the USDA forecast for the full marketing year versus the five-year average of 32.6%, the issues on the Mississippi River may worsen this slow start

- Corn futures have traded in a rather tight 40-cent range over the past four weeks continuing to hang near the $7 level

- A generally favorable weather outlook for the next few weeks should allow corn harvest progress to surge after a slower-than-normal start

Soybeans Slightly Higher this Week

- November CBOT soybean futures added 2-1/4 cents this week to close at 1367

- Low water levels on the Mississippi River hammered spot soybean basis levels lower all along the river system, the largest US barge operator declared force majeure last week due to the water levels

- Soybean export sales are running over 9% ahead of last year’s pace to date, while early in the marketing year this is a good sign compared to the sluggish export start corn has had

- The prospect of another huge South American soybean crop may weigh on soybean futures in the weeks to come if Southern Hemisphere weather remains favorable

- Rallying crude oil futures this week helped support the entire commodity complex, soybean oil futures found support at the 100-week moving average late last week and posted their best week since late July this week

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat Prices Lower for the Week

- December CBOT wheat futures shed 41-1/4 cents this week to close at 880-1/4

- December KCBOT wheat futures shed 22-3/4 cents this week to close at 968-3/4

- December MGEX spring wheat futures shed 14 cents this week to close at 968

- For the USDA Supply/Demand report on Wednesday, traders see wheat ending stocks near 563 million bushels as compared with 610 million in the September update

- Rains are forecast for some of the plain’s states in the coming weeks, but relief may only be temporary as subsoil moisture levels remain depleted

- Spring wheat futures ran up against the psychological resistance level of $10 this week and last, from their August lows to recent highs spring wheat futures had rallied $1.40

Milk Trades Higher This Week

Now front month October futures in both Class III and Class IV found gains this week. Class III futures finished last week at $21.75 and settled today at $22.11. These gains can be contributed to a strong spot cheese trade, up 4 cents per pound this week on 19 loads traded, blocks settled at $2.0225 and barrels at $2.225, averaging $2.12375. Class IV October futures gained nearly 50 cents on the week to close today at $24.85. Spot butter continues higher, with more than 7 cent gains on the week to finish at $3.2175 per pound and likely the reason for much of Class IV weekly gains.