Corn continues sideways

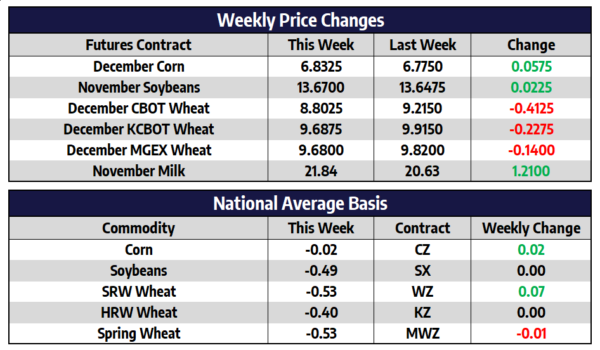

- December CBOT corn futures added 6-1/2 cents today to close at 689-3/4.

- July of 2023 CBOT corn futures added 3-3/4 cents today to close at 690-3/4.

- China is continuing to strengthen its relationship with Brazil, at least 45 Brazilian facilities have been approved to ship corn to China already, this is not a good sign for US corn with export commitments running over 50% behind last years pace.

- After trading above $7 on Monday for the first time since June front month corn closed the week back in its recent sideways range.

- A surge higher in energy prices, lower trade in the US dollar and a rally in the stock market all helped support corn futures this week.

- Unless the demand picture changes dramatically soon corn will be at the risk of a correction given upcoming harvest pressure.

Soybeans higher this week with new USDA data

- November CBOT soybean futures added 16-3/4 cents this week to close at 1383-3/4.

- July 2023 CBOT soybean futures added 10-3/4 cents this week to close at 1413.

- Only four of the 12 railroad unions have ratified the tentative agreement to avoid an upcoming strike; if all 12 unions do not agree by November 14, a rail union strike will be back on the table.

- The USDA cut is soybean crop estimate by 65 million bushels from last months estimate this week bring carryout back to the 200-million-bushel mark.

- The weight of outside influence from inflation and a slowing global economy along with continued harvest pressure could stop the recent post USDA report rally in soybeans.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat prices lower for the week

- December CBOT wheat futures shed 20-1/2 cents this week to close at 859-3/4.

- December KCBOT wheat futures shed 16-1/2 cents this week to close at 952-1/4.

- December MGEX wheat futures shed 13-3/4 cents this week to close at 954-1/4.

- The USDA raised its 2022/23 US spring wheat ending stocks by 3 million bushels to 130 million bushel this week, this is the smallest ending stocks since 2007/08.

- A backing off of the US dollar was not enough to provide strength to the wheat complex this week.

- The Buenos Aires Grains Exchange sees wheat production at 16.5 million tons, down from 17.5 million as there prior estimate and down from 22.4 million tons last year.

Strong selloff in Class III to end week

In this week’s dairy trade, last week’s move higher was erased with a strong selloff, the punctuation mark being Friday’s trade in Class III where November contracts closed limit down and December lost 59 cents. Class III November contracts opened the week at $21.89 and settled on Friday’s close at $20.41. A pattern has emerged since early September of seeing second month Class III contracts fail to break above $22.00 and make a strong move lower and find support above $20.00. This large move lower in Class III can likely be attributed to the spot cheese market losing nearly 5 cents on Friday’s trade and moving spot cheese lower overall on the week. Spot butter and powder were also down on the week with 5.50 and 4.00 cent losses and settlements of $3.1750/lb and $1.49/lb, respectively. Spot whey was the only gainer on the week, up nearly 3 cents to $0.4425 per pound. Class IV November futures followed suit and lost 69 cents on the week to settle on Friday at $23.41. Fundamental news was quiet this week while equities and outside markets were volatile.