Corn lower this week as harvest pushes on

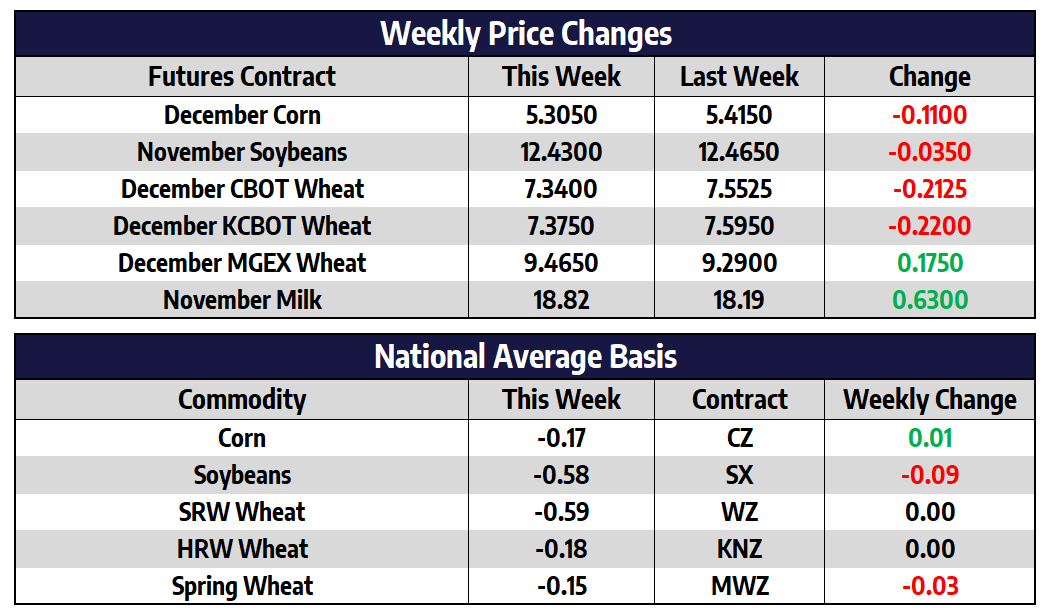

December corn futures shed 11 cents this week to close at 530-1/2. July of 2022 corn futures shed 9-1/2 cents this week to close at 545-1/2. Energy and fertilizer prices continued moving higher this week but were not enough to push the corn market higher. A gauge of North American fertilizer prices from Bloomberg soared to a record high this week surpassing the previous highs set in 2008. As costs for next years crop continues to climb so does the threat of worsened food inflation, which has also been on the rise.

Wetter weather is expected throughout the Midwest next week, but warm and dry soils in many areas should dry out rather quickly and allow for harvest to resume between rounds of rain. Next Tuesday will bring the latest supply and demand update from the USDA. Traders see US ending stocks coming in near 1.432 billion bushels as compared with 1.408 billion in the September report. US corn production is also expected to decline slightly to come in near 14.973 billion bushels. The expected decline comes from an estimated yield number of 176 bushels per acre versus the 176.3 bushels per acre estimated in September. An increase to the nation yield estimate as the trade is anticipating a yield cut would more than likely push the market lower and retest the $5 area that has been well supported all year.

Soybeans slightly lower this week

November soybean futures shed 3-1/2 cents this week to close at 1243. July of 2022 futures were a penny lower this week to close at 1277-1/2. Soybean futures found strength early in the day on Friday on rumors of Chinese interest in US soybeans. Export sales for soybean after starting the marketing year slightly ahead of the pace needed to meet the USDA’s 2021/22 projection are currently running 87 million bushels behind the needed pace. The market will look for confirmation of this rumor to start next week as well as focus on Tuesday’s USDA supply and demand report.

For the USDA Supply/Demand update next week, traders see US ending stocks near 300 million bushels (161-373 million range) as compared with 185 million bushels in the September report. Traders expect production to come in near 4.415 billion bushels (4.374-4.466 billion range) as compared with 4.374 billion bushels in the September update. Traders expect yield to come in near 51.1 bushels per acre (50.5-51.5 range) as compared with 50.6 for the September update. Big picture support should come in for soybeans at the $12 level with resistance at the August highs near $13.80.

Spring wheat higher, winters lower this week

December CBOT wheat futures shed 21-1/4 cents this week to close at 734. December KC wheat futures shed 22 cents this week to close at 737-1/2. December MPLS spring wheat futures added 17-1/2 cents this week to close at 946-1/2. For the USDA Supply/Demand update next week, traders see US ending stocks near 576 million bushels as compared with 615 million bushels in the September report. World ending stocks are expected to come in near 280.82 million tons, 278-284.5 range, as compared with 283.22 million tons from the September update. Weekly export sales showed that for the week ending September 30, net wheat sales came in at 333,218 tons. Cumulative sales have reached 47.9% of the USDA forecast for the 2021/2022 marketing year versus a 5-year average of 51.5%.

Class IV Milk Breaks Out into New Multi-Year Highs

The November Class IV contract was up 33 cents this week and broke out to the topside, closing over $17.41, which has been the top end of the range since late 2014. This breakout gives Class IV prices more upside potential in the months ahead. Class IV has been the leader all year, not dropping as much as Class III prices during the late spring/early summer selloff, and are now providing leadership to the topside. Class III prices are still at a premium to Class IV, yet it is Class IV that has outperformed relative to it’s more recent range.

For the week, November Class III was up 62 cents, yet is still about 120 cents away from it’s spring high of $20.05. Milk prices gained in anticipation of further cheese price gains. This week, the block/barrel average only gained 1/4 of a cent and has been finding resistance just under the spring high of $1.8240. The breakout in Class IV prices should help give the cheese market increased potential to get through that spring high resistance, yet it might only have a couple weeks to do so if it’s going to do it in 2021 as November and December have not been good calendar months for higher cheese prices historically. Surprisingly, through this entire rally in cheese off of its August low of $1.4725, the Funds have been selling into it by shorting Class III futures. The Funds are net short about 3,000 contracts which is a large bearish position for them, especially in relation to open interest. The Funds may be making a big bet on cheese staying range bound for the near term. If they are wrong though and are forced to buy these contracts back, it could fuel to any upside breakout move.