Front month corn down this week

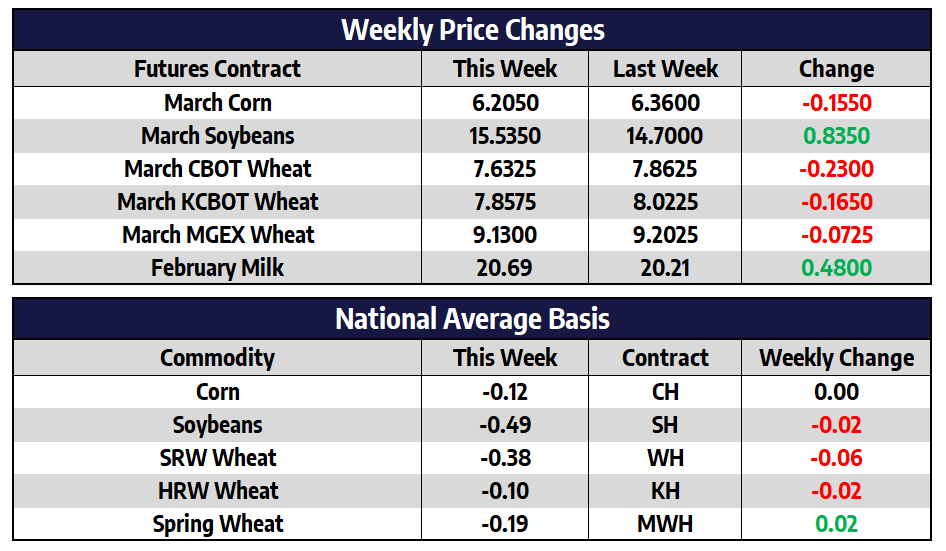

Front month March corn futures shed 15-1/2 cents this week to close at 620-1/2. December corn futures this week added 4-1/2 cents to close at 573-3/4. New crop corn has pushed higher in five consecutive weeks. Negative ethanol margins and a slowdown in export demand as of late has yet to reflect in basis levels. This could be the first sign to begin eroding the inverse the market still finds itself in. Next week Wednesday’s USDA report is historically a sleeper when it comes to market movement, but with increased outside interest in the corn market, small changes could bring larger than normal price swings.

The USDA confirmed the cancellation of about 15 million bushels of old crop 2021/22 corn on Thursday. This was the largest one-day cancellation of corn by any country as far back as recent data goes. The USDA attaché to China this week left his corn import forecast at 20 million tons. This compares with the current USDA estimate to 26 million tons. The attaché cited a larger Chinese corn crop in 2021 as well as China looking to Ukraine to meet their corn needs in the coming months.

Soybeans push above $15 this week

Front month soybean futures added 83-1/2 cents this week to close at 1553-1/2. New crop November soybean futures added 44-1/4 cents this week to close at 1395-3/4. New crop futures have close higher in 6 of the last 7 weeks. While the market remains extremely overbought, increasing open interest this week suggests the funds are still aggressively buying soybeans. This was the largest weekly gain for front month soybeans since late June.

For the February USDA Supply and Demand report, traders see soybean ending stocks near 310 million bushels, as compared with 350 million bushels in the January update. World ending stocks are expected near 91.5 million tons, as compared with 95.2 million tons in the January update. Brazil soybean production is expected near 133.6 million tons, as compared with 139 million tons in January. Argentina production is expected near 44.5 million tons, as compared with the January update at 46.5 million tons.

Like what you’re reading?

Sign up for our other free daily TFM Market Updates and stay in the know!

Wheat trends lower this week

Front month March CBOT wheat futures shed 23 cents this week to close at 763-1/4. March KC wheat futures shed 16-1/2 cents this week to close at 785-3/4. March spring wheat futures lost 7-1/4 cents this week to close at 913. Selling pressure this week pushed wheat prices to their lowest level since January 14th. Poor US export sales and falling European wheat futures along with falling corn prices all added selling pressure this week. For the February USDA Supply and Demand report, traders see US wheat ending stocks near 629 million bushels, as compared with 628 million bushels last month. World ending stocks are seen near 279.9 million tons, as compared with 279.9 million in January.

Dairy Finishes the Week Strong

The milk market finished a choppy week of trade on the right foot with steady double-digit gains on Friday. A strong turnaround in the spot cheese price is leading the charge to higher milk prices. The spot cheese block/barrel average has now closed higher for sevens sessions in a row after falling lower for nine in a row before this rally. Blocks added 2c on Friday to $1.90/lb, while barrels added 4.25c to $1.8950/lb. There were 5 loads traded total. An up day of 22c to 41c in the nearby class III contracts brings milk green for the week. The now second month March 2022 contract added 31c total and closed up at $21.66 per cwt. April added 36c this week and closed at $21.80 per cwt. Over in class IV, it was another steady week of trade. Spot butter closed the week up at $2.50/lb, while powder closed at $1.8325/lb.

The strong turnaround in the US cheese market is encouraging and could prevent these class III contracts from going through a bigger correction. It is also encouraging to see buyers return to the spot butter trade and support that market back to $2.50/lb. Market technicals still lean overbought, though, which could still create a selloff in the market to reset the indicators. Although, if the spot markets continue to receive bidding, that correction could be delayed. For now, the milk market still holds in a bigger picture uptrend.