Pro Farmer sees US corn crop at 177 bpa vs USDA at 174.6

December of 2021 corn futures shed 36 cents this week to close at 537, their lowest close since the first week of July. December of 2022 futures shed 17-3/4 cents this week to close at 499. The Pro Farmer crop tour conducted this week across the Midwest is estimating the national corn yield at 177 bushels per acre. The tour pulled over 3400 samples across seven states to compile their estimate. A common theme from the crop tour samples was high ear counts. Near perfect planting conditions and an ideal start to the growing season is believed to have resulted in the higher-than-normal ear counts. From Pro Farmer – “Bottom line: The “factory” is there to produce record yields.”

Reuters reported on Friday that the US Environmental Protection Agency is expected to recommend to the White House lowering the nation’s biofuel blending mandates below 2020 levels. The EPA is looking to align mandates with actual production levels, which have slumped during the coronavirus pandemic. The mandates determine the amount of biofuels that oil refiners must blend into their fuel mix. This is expected to be a blow to the biofuels industry after recent years of tight margins.

Soybeans hammered lower this week

November soybean futures shed 74-1/4 cents this week to close at 1290-3/4. November of 2022 futures shed 30 cents this week to close at 1226-1/2. Pro Farmer is estimating the national soybean yield to come in at 51.2 bushels per acre. The tour conducts pod counts of a three foot by three-foot square to estimate the soybean crops potential. The Illinois soybean crop was the best the tour has ever seen in any state. Pod counts were very strong, and the state should have enough moisture to finish the crop out well. Indiana, Iowa and Ohio pod counts weren’t as consistent as Illinois, but the pods are there to produce record yields if these states get some timely late season rains. Rains late today and into the weekend across the western Midwest will be a welcome sign for many and should go a long way in finish out this bean crop.

Soybean price action was very poor this week as new crop futures had their worst week since mid-June. Tuesday’s failed breakout to the topside added selling pressure the rest of the week. On both Thursday and Friday new crop prices fell over 25 cents. Outside market forces were also bearish this week as the US dollar continued its move higher and weakness in world equity markets appeared. The 200-day moving average and the mid-June lows near 12.40 should act as first support on a continued pull back next week.

All three wheats lower as US dollar traded to new yearly highs

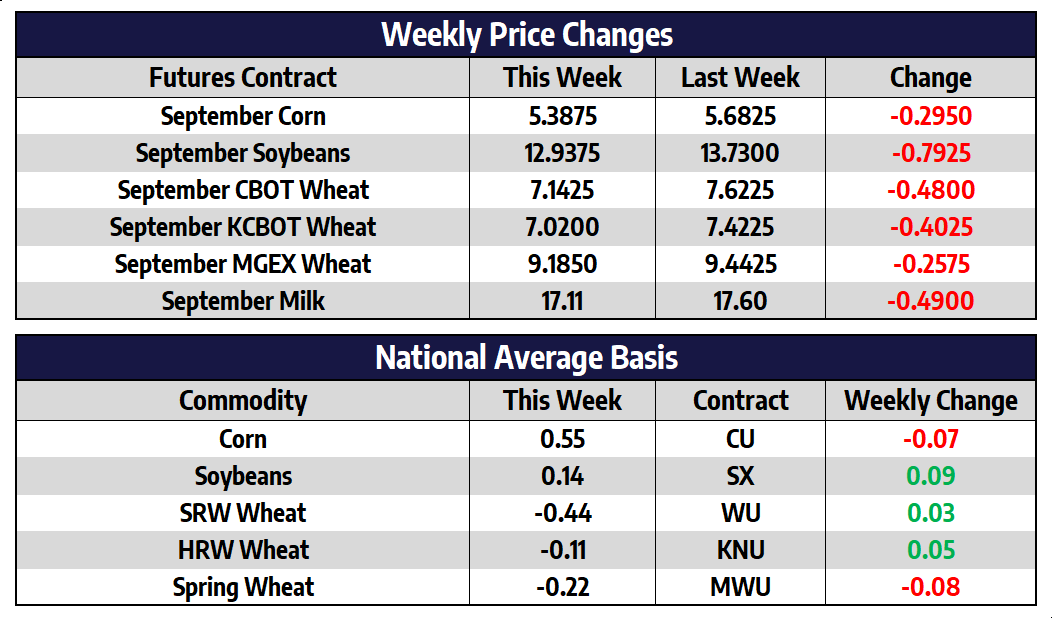

September CBOT wheat futures shed 48 cents this week to close at 714-1/4. September KC wheat futures shed 40-1/4 cents this week to close at 702. September spring wheat futures shed 25-3/4 cents this week to close at 918-1/2.After rallying to new contract highs last week Friday, wheat prices were hammered lower this week pushing prices below levels seen prior to the USDA’s bullish August report. Sector wide commodity prices slid lower this week. Outside forces are believed to shoulder much of the blame. The US dollar rallied to its highest level of 2021 this week as global unrest fears continued to emerge. The situation in Afghanistan and continued rising Covid-19 cases around the world scared any an potential continued commodity buying interest. All three wheats were in overbought territory to start the week, the 100-day moving average should act as first support on Chicago wheat just below the $7 per bushel level.

Recapping This Week’s Dairy Trade

The class III milk market struggled this week as contracts weren’t able to add to last week’s strong gains. The second month contract fell 51c after rising $1.13 in the prior week’s trade. The October contract fell 64c after jumping 70c higher a week ago. The market ran into selling pressure stemmed from a weaker spot trade along with outside market weakness. The US Dollar Index hit a new high of year while the feed market is starting to struggle. For the spot trade, spot cheese was down 4.625c, powder was down 2c, butter lost 0.75c, and whey added 1.25c. The class IV milk futures market saw little price movement with few contracts traded. The second month class IV contract added just 4c to $15.91.

News this week for dairy included a Global Dairy Trade auction on Tuesday along with a USDA milk production report on Thursday. Both news events were friendly to the market. The Global Dairy Trade price index added 0.30%, which was the first up auction since April 6, 2021. This breaks a streak of eight red auction events. Within the event, the global butter price added 4% and the global cheese price added 2.80%. Additionally, the US milk production report for July showed just a 2% increase in production growth. Cow numbers declined for the second month in a row and are now 9,000 head off of this year’s peak. The 2.00% year-over-year growth was well below recent growth totals.