April 14, 2022

Milk Recap – Cheese Jumps 5.125c Thursday

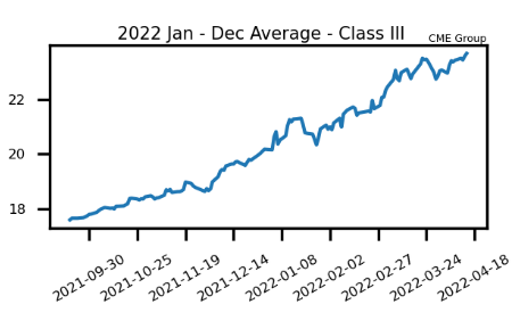

US cheese continues to be the main driver of higher milk prices so far this week with buyers getting aggressive again on Thursday. Buyers pushed up blocks another 4.25c to $2.3725/lb on 5 loads traded. The barrel market added 6c to $2.44/lb on a whopping 10 loads traded. Demand is still very strong for US cheese. The bidding in cheese took class III milk futures higher and the May 2022 contract retested the all-time high class III price of $25.55 intraday. May finished the session up 29c to $25.46 on 366 contracts traded. Most class III contracts closed up double digits and there was some heavy bidding out into the 2023 strip. April 2023 added 35c, May added 43c, and June added 20c. The market continues to keep hefty premium out in those contracts.

The class IV market was up on Thursday as well, although bidding wasn’t as aggressive as in the class III market. There was some offering in the spot butter trade that may have kept a lid on class IV today. The US spot butter price fell 2c lower to $2.7550/lb. Butter hasn’t posted an up day since April 7th. There was bidding in powder today that took the spot price up 0.25c to $1.8225/lb. The dairy market will be closed tomorrow in observance of the Good Friday holiday and will re-open on Sunday night. Next week will have quite a few news events for the market with a Global Dairy Trade auction Tuesday, a milk production report release on Wednesday, and the monthly cold storage report on Friday.

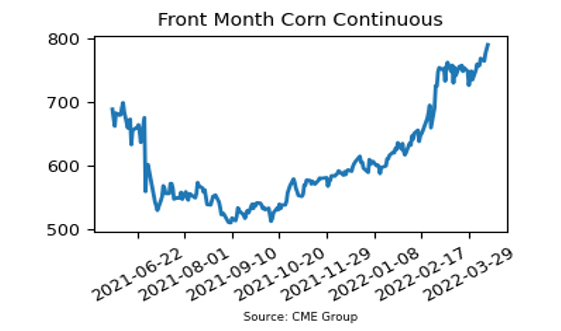

Corn Surges Higher

The front month May corn futures contract closed higher in three out of the four sessions this week, adding a total of 21.50c and closing up at $7.9050/bu. The market continues to receive support in both old crop and new crop contracts as expected planted corn acres will be their lowest since 2018. Even the December 2022 corn contract has seen a lot of premium added to the contract in recent weeks. The contract is up four weeks in a row, adding 89.75c over that stretch. December corn closed Thursday at $7.3525 per bushel. Planting progress will be watched closely in the coming weeks as the US is currently behind the 5-year planting pace. Although it still is very early in the planting season. Rains in the eastern corn belt over the coming days are expected to delay plantings. The Buenos Aires Grain Exchange rated 20% of Argentina’s corn crop good to excellent, which was down 1% from last week. The grain markets will be closed tomorrow in observance of the Good Friday holiday.

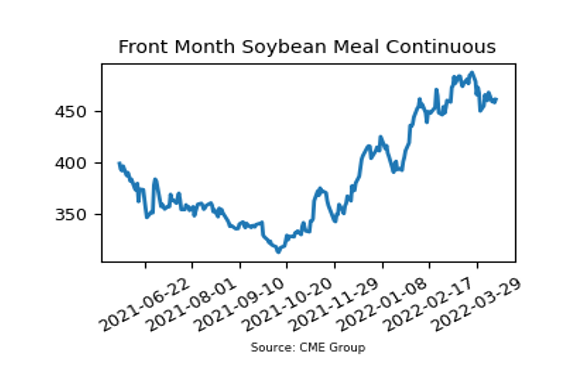

Soybean Meal Consolidates Above $450/ton

The soybean meal futures market has gone three weeks now without putting in a new high for the move. Market conditions have changed after the USDA said that there would be a record number of soybean acres planted in the US this year. For now, the market is consolidating just above the $450/ton level. Export demand should help keep levels somewhat elevated despite an expected large crop size this year. It was reported on Thursday that China bought 132,000 mt of soybeans from the US for delivery during the 21/22 marketing year. There is also a possibility for increased US exports as Brazil will be out of the marketplace. Front month soybean meal currently sits at $461.40 per ton while the December contract is down at $418.90 per ton.

Friday’s Market Quotes