May 7, 2021

Spot Markets Mostly Lower This Week

It was not a good week for dairy spot markets. Butter was the lone product that was able to eek out a slight week-over-week gain, otherwise cheese, whey, and nonfat all closed the week lower. As the US hits what should be the peak of the flush season this month, spot prices of Midwest milk are reportedly ranging from $4.50 under to $0.50 over Class, with the average around $2.00 under. Class III and Class IV markets were lower today and lower on the week: May C3 -36c, Jun C3 -97c, May C4 -14c, & Jun C4 -27c. Feed markets were significantly higher on the week with July corn +57c, July beans +59c, July meal +14.7d, & July wheat +30c. The US Dollar lost nearly a full 100 points this week from 91.28 last Friday, to 90.30 today. Much of that drop occurred today as the dollar fell 66 points following a disappointing US jobs report. This week’s dollar decline should help offset some of the competitive advantage that US dairy products lost earlier in the week, following a weaker GDT auction that saw prices for cheese and butter drop -4.5% and -12.1%, respectively. No major dairy reports are scheduled for release next week. The USDA will release it’s May World Supply and Demand Estimates at 11:00am CT on Wednesday, which will likely be a catalyst for additional grain market volatility next week.

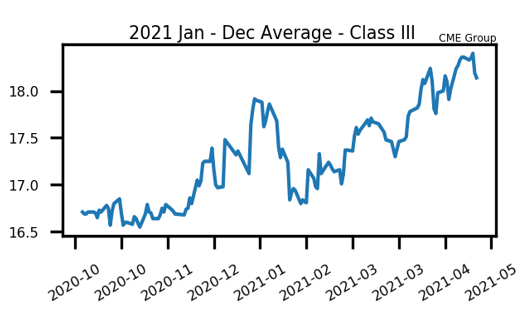

Milk Highlights:

The 2021 Class III average made a new high for the move to $18.40 before Thursday’s sell off

Global Dairy Trade – Trade Weighted Index fell 0.7% this week. GDT butter fell 12.1% & Cheese fell 4.5%

Weekly dairy cow slaughter continues to slow, and the number of head slaughtered YTD is only 9,100 head more than last year at this time

Corn Market New Multi-Year Highs

July corn finished the week up another 57 cents, taking out the 7.2050 high that the May contract hit before going into delivery. Closing over 7.2050 for the week opens the door for the market to challenge the 2008 high of 7.7900. The market appears to be quickly trying to price in worst case scenarios across the board, particularly a disaster for South America’s corn crop. A number of analysts aggressively lowered their Brazil corn crop estimates this week, with some forecasted production as low as 85 mmt. That compares to the last USDA estimate of 109 mmt. Early in the week China cancelled 140,000 mt of 2020/2021 US corn, only to turn around today and buy 1,400,00 mt of 2021/2022 US corn. Planting progress for Monday’s Crop Progress is expected to show the US about 70% planted.

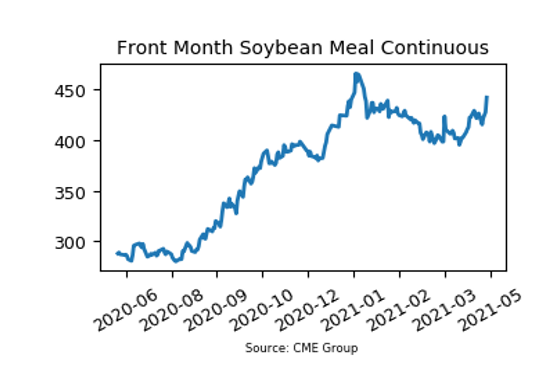

Soybean Meal Breaks Out

July soybean meal posted it’s biggest up day this week since the day of the March Planting Intentions report on March 31st. For the week, July meal was up 14.70 dollars, and closed over the March/April highs. This makes the January high of 471.00 the next objective for the market. YTD meal exports are essentially flat with last year. Since January, market participants have shown little motivation to buy soybean meal, but the continued surge in soybeans and soybean oil appears to be turning the tide back towards bullish momentum. Planting progress for Monday’s report is expected to show the US soybean crop 54-57% planted.

Today’s Market Quotes