October 8, 2021

New 6 Year Highs for Class IV Milk

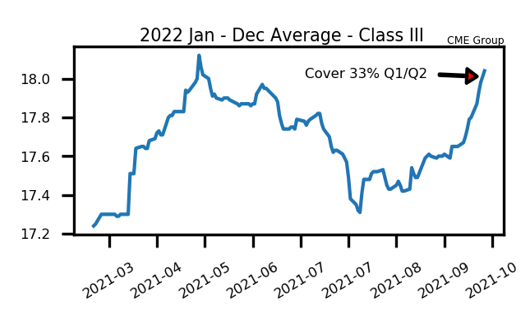

The November Class IV contract was up 33 cents this week and broke out to the topside, closing over $17.41, which has been the top end of the range since late 2014. This breakout gives Class IV prices the potential to test $20.00+ in the months ahead. Class IV has been the leader all year, not dropping as much as Class III prices during the late spring/early summer selloff, and are now providing leadership to the topside. Class III prices are still at a premium to Class IV, yet it is Class IV that has outperformed relative to it’s more recent range of the last 16 months.

For the week, November Class III was up 62 cents, yet is still about 120 cents away from it’s spring high of $20.05. Milk prices gained in anticipation of further cheese price gains. This week the block/barrel average only gained 1/4 of a cent and has been finding resistance just under the spring high of $1.8240. The breakout in Class IV prices should help give the cheese market increased potential to get through that spring high resistance, yet it might only have a couple weeks to do so if it’s going to do it in 2021 as November and December have not been good calendar months for higher cheese prices historically. Surprisingly, through this entire rally in cheese off of its August low of $1.4725, the Funds have been selling into it by shorting Class III futures. The Funds are net short about 3,000 contracts which is a large bearish position for them, especially in relation to open interest. The Funds may be making a big bet on cheese staying range bound for the near term. If they are wrong though and are forced to buy these contracts back, it could fuel to any upside breakout move.

Corn Market Strengthens This Week

December corn was down about 11 cents on the week. Over the last two weeks the Dec contract has struggled to gain much traction over the 5.4000 level. Overall, higher energy prices, tight corn supplies, and stronger wheat prices lend support on the downside, while US harvest progress, slow export demand, and South American full-season corn planting progress provide overhead resistance. Next week’s USDA report is of significant interest to the market to see if the US crop is going to continue trending larger going forward, or whether USDA will reverse last month’s yield increase.

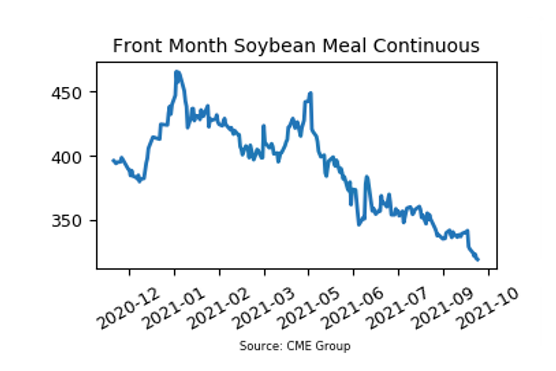

SBM Hits Lowest Price Since 11/2020

December soybean meal finished the week down about 8 dollars. This is the fourth consecutive down week, and the seventh down week out of the last eight weeks. The market has been down almost 5-1/2 consecutive months and over that span has declined about 107 dollars from the end of April to today’s close. Soybean exports have been surprisingly slow, especially given current tightness in supplies, as total US export commitments are behind last year by about 38% as of the latest week. South American soybean planting will become of greater concern to the market towards the end of the month. Next week’s USDA report for soybeans will be of a similar interest as corn — which direction will yield trend going forward? The report next week could provide some clues.

Today’s Market Quotes